Restaurant employment declined for the second time within the final three months, because the latest softer sales readings seem like impacting the labor market.

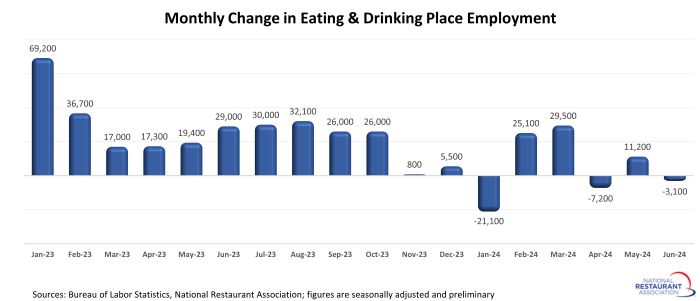

Consuming and consuming locations* minimize a internet 3,100 jobs in June on a seasonally-adjusted foundation, in line with preliminary knowledge from the Bureau of Labor Statistics (BLS). That adopted downward-revised readings in each April (-7,200) and Could (+11,200).

In complete throughout the 2nd quarter, consuming and consuming locations added simply 900 jobs. That represented the weakest quarterly employment efficiency for the reason that 4th quarter of 2020, when the trade shed greater than 285,000 jobs within the face of the delta variant of COVID-19.

Regardless of the latest slowdown, the trade workforce stays barely above pre-pandemic ranges. As of June 2024, consuming and consuming locations have been practically 36,000 jobs (or 0.3%) above their February 2020 employment peak.

Labor market could also be normalizing

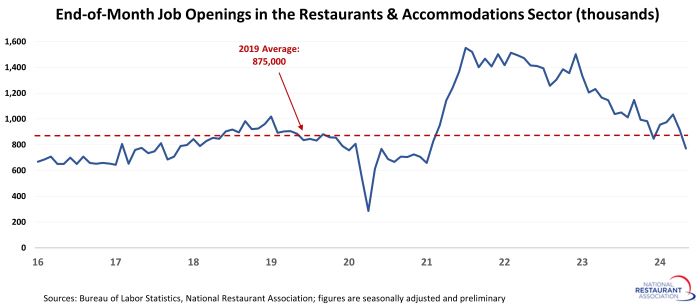

Trying past the headline numbers reveal labor market dynamics which can be extra consistent with pre-pandemic circumstances. There have been fewer than 800,000 job openings within the mixed eating places and lodging sector on the final enterprise day of Could, in line with preliminary knowledge from the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS).

That represented the bottom studying in additional than 3 years, and was effectively under the document highs of greater than 1.5 million openings registered a number of months throughout 2021 and 2022. It was additionally barely under 2019’s common month-to-month stage of 875,000 job openings.

One purpose for the downward development in job openings could also be a discount within the churn fee of present workers.

Solely 4.1% of workers within the mixed eating places and lodging sector stop their jobs in Could, in line with BLS. That marked the 4th consecutive month under 5%, and was effectively under 2019’s common month-to-month stop fee of 4.9%.

Notice: The job openings and quits knowledge introduced above are for the broadly-defined Lodging and Meals Companies sector (NAICS 72), as a result of the Bureau of Labor Statistics doesn’t report knowledge for eating places alone. Consuming and consuming locations account for practically 90% of jobs within the mixed sector.

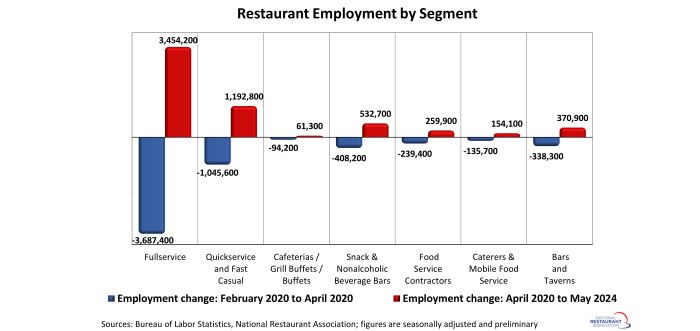

Fullservice phase nonetheless down 233k jobs

The fullservice phase skilled probably the most job losses throughout the preliminary months of the pandemic – and it nonetheless has the longest path to restoration. As of Could 2024, fullservice restaurant employment ranges have been 233,000 jobs (or 4%) under pre-pandemic readings in February 2020.

Employment counts within the cafeterias/grill buffets/buffets phase (-30%) additionally remained under their February 2020 ranges.

Job losses within the limited-service segments have been considerably much less extreme throughout the preliminary months of the pandemic, as these operations have been extra more likely to retain employees to assist their present off-premises enterprise. As of Could 2024, employment at snack and nonalcoholic beverage bars – together with espresso, donut and ice cream retailers – was practically 125,000 jobs (or 15%) above February 2020 readings.

Staffing ranges within the quickservice and quick informal segments have been practically 150,000 jobs (or 3%) above pre-pandemic ranges. Headcounts at bars and taverns have been 33,000 jobs (or 8%) above the pre-pandemic peak.

[Note that the segment-level employment figures are lagged by one month, so May is the most current data available.]

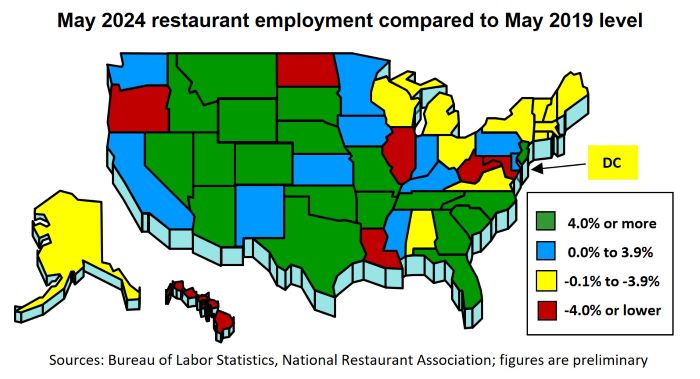

Restaurant workforce restoration uneven throughout states

The extent of the restaurant trade’s workforce restoration continues to differ considerably by state. As of Could 2024, 20 states and the District of Columbia had fewer consuming and consuming place jobs than they did in Could 2019.

This group was led by Maryland, North Dakota and Louisiana, which had 7% fewer consuming and consuming place jobs in Could 2024 than they did in Could 2019. Hawaii (-6%), West Virginia (-6%), Illinois (-4%) and Oregon (-4%) have been additionally effectively under their pre-pandemic restaurant employment ranges.

As of Could 2024, consuming and consuming place employment in 30 states surpassed their comparable pre-pandemic readings in Could 2019. This group was led by South Dakota (+14%), Nevada (+14%), Utah (+14%), Montana (+12%) and Texas (+11%).

[Note that the state-level analysis uses May 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available.]

*Consuming and consuming locations are the first part of the whole restaurant and foodservice trade, offering jobs for roughly 80% of the whole restaurant and foodservice workforce of 15.5 million.

Learn extra analysis and commentary from the Affiliation’s economists.