Resilient U.S. customers, who largely shrugged off rising rates of interest to gasoline the post-pandemic economic system, could also be beginning to lose some momentum.

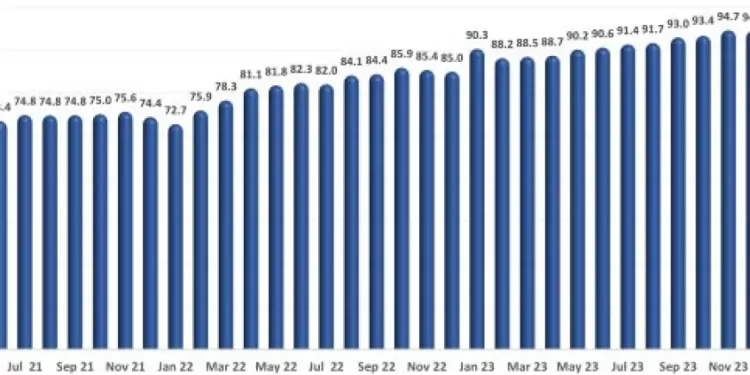

Consuming and ingesting locations* registered complete gross sales of $93.6 billion on a seasonally adjusted foundation in Might, in response to preliminary knowledge from the U.S. Census Bureau. That was down 0.4% from April and represented the bottom month-to-month gross sales quantity since October 2023 ($93.4 billion).

Client spending in different retail sectors was additionally mushy in Might, although it held up barely higher than eating places. Non-restaurant retail gross sales edged up 0.2% in Might, which adopted a 0.3% decline in April.

Whereas general restaurant gross sales dipped in latest months, common menu costs continued to rise. In consequence, actual restaurant gross sales misplaced floor relative to 2023 ranges. After adjusting for menu worth inflation, consuming and ingesting place gross sales fell to their lowest month-to-month stage since April 2023.

Though restaurant gross sales softened in latest months, the underlying energy of the U.S. labor market will possible proceed to help client exercise within the months forward. Employed customers will spend cash, and there’s little concern that economic conditions will deteriorate to the purpose that there might be job losses within the close to time period.

*Consuming and ingesting locations are the first part of the U.S. restaurant and foodservice business and signify roughly 75% of complete restaurant and foodservice gross sales. Month-to-month gross sales figures offered above signify complete revenues in any respect consuming and ingesting place institutions. This differs from the Nationwide Restaurant Affiliation’s gross sales projections, which signify meals and beverage gross sales at institutions with payroll workers.

Learn extra analysis and commentary from the Affiliation’s economists, together with the newest outlook for consumers and the economy.