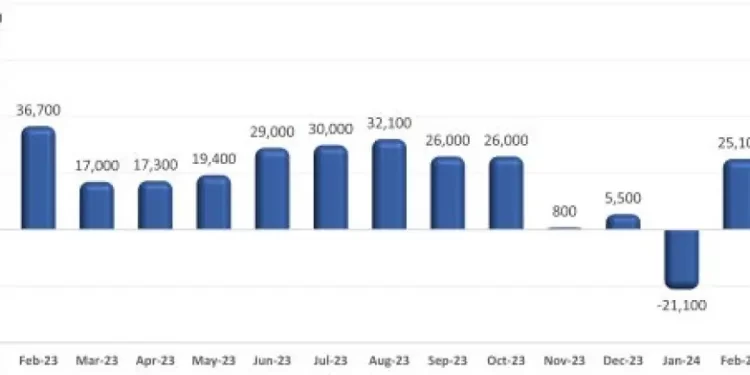

After a tender patch to start the yr, restaurant job development began to regain some footing in latest months.

Consuming and ingesting locations* added a internet 24,600 jobs in Might on a seasonally-adjusted foundation, in accordance with preliminary knowledge from the Bureau of Labor Statistics (BLS). That represented the third time within the final 4 months that the trade added at the very least 24,000 jobs, which is roughly on par with the typical month-to-month job development throughout 2023.

On a non-seasonally-adjusted foundation, consuming and ingesting locations added greater than 380,000 jobs in April and Might. That places eating places on observe so as to add more than 500,000 seasonal jobs this summer time, in accordance with Nationwide Restaurant Affiliation projections.

Restaurant job development was uneven in latest months, however general employment ranges proceed to climb above pre-pandemic ranges. As of Might 2024, consuming and ingesting locations had been practically 69,000 jobs (or 0.6%) above their February 2020 employment peak.

Fullservice section nonetheless down 234k jobs

The fullservice section skilled probably the most job losses throughout the preliminary months of the pandemic – and it nonetheless has the longest path to restoration. As of April 2024, fullservice restaurant employment ranges had been 234,000 jobs (or 4%) beneath pre-pandemic readings in February 2020.

Employment counts within the cafeterias/grill buffets/buffets section (-31%) additionally remained beneath their February 2020 ranges.

Job losses within the limited-service segments had been considerably much less extreme throughout the preliminary months of the pandemic, as these operations had been extra prone to retain employees to help their current off-premises enterprise. As of April 2024, employment at snack and nonalcoholic beverage bars – together with espresso, donut and ice cream retailers – was practically 117,000 jobs (or 15%) above February 2020 readings.

Staffing ranges within the quickservice and quick informal segments had been practically 150,000 jobs (or 3%) above pre-pandemic ranges. Headcounts at bars and taverns had been 28,000 jobs (or 6%) above the pre-pandemic peak.

[Note that the segment-level employment figures are lagged by one month, so April is the most current data available.]

*Consuming and ingesting locations are the first element of the entire restaurant and foodservice trade, offering jobs for roughly 80% of the entire restaurant and foodservice workforce of 15.5 million.

Learn extra analysis and commentary from the Affiliation’s economists, together with the Restaurant Financial Insights blog.