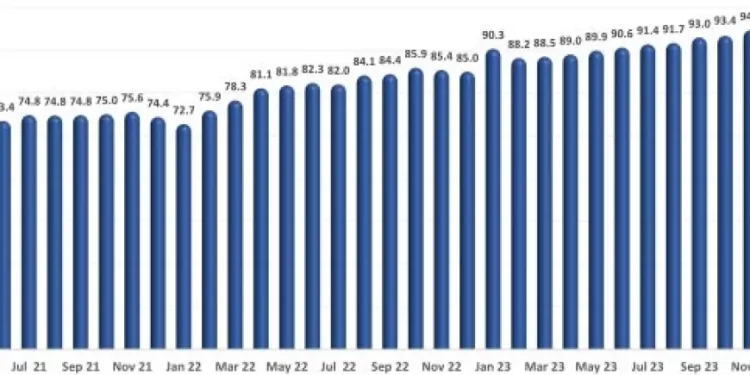

Client spending in eating places edged increased in April, however total gross sales quantity remained decrease than the latest highs posted in late-2023.

Consuming and ingesting locations* registered complete gross sales of $93.9 billion on a seasonally adjusted foundation in April, in accordance with preliminary information from the U.S. Census Bureau. That was up 0.2% from a complete gross sales quantity of $93.7 billion in March.

Regardless of the modest enhance, April represented the continuation of a latest mushy patch in restaurant gross sales. After topping $94.5 billion in each November and December, complete consuming and ingesting place gross sales quantity dropped under $94 billion throughout every of the primary 4 months of 2024.

Though restaurant gross sales leveled off in latest months, they nonetheless held up comparatively nicely in comparison with different retail sectors. The 5.5% enhance in consuming and ingesting place gross sales between April 2023 and April 2024 was greater than double the two.7% achieve in non-restaurant retail gross sales throughout the identical 12-month interval.

Whereas total restaurant gross sales had been flat in latest months, menu costs continued to pattern increased – albeit at a a lot slower tempo than in 2022 and 2023. Consequently, the trendline of actual restaurant gross sales turned barely destructive. After adjusting for menu worth inflation, consuming and ingesting place gross sales declined in 4 out of the final 5 months.

Pent-up demand stays agency

Whereas total restaurant gross sales remained comparatively flat through the first 4 months of the 12 months, the Nationwide Restaurant Affiliation’s measures of pent-up demand held regular. Forty-four % of adults say they aren’t going out to eating places as typically as they want, in accordance with a survey fielded Could 3-5, 2024. That was basically on par with client surveys fielded over the past 2 years.

In the meantime, 38% of adults say they aren’t ordering takeout or supply from eating places as typically as they want. That was up barely from latest surveys.

Members of Technology X are the almost certainly to say they aren’t utilizing eating places sufficient. Forty-seven % of Gen Xers say they aren’t consuming on premises at eating places as typically as they want. Lower than 4 in 10 Gen Z adults reported equally.

Gen Xers and child boomers are the almost certainly to say they aren’t ordering takeout or supply from eating places as typically as they want.

Pent-up demand is increased amongst lower-income households, with a majority of shoppers in households with earnings under $50,000 saying they wish to exit to eating places and order takeout/supply extra regularly.

In the meantime, practically 3 in 10 adults dwelling in households with earnings above $100,000 say they aren’t going out to eating places as typically as they want.

Any quantity of unfulfilled demand amongst higher-income households is a vital indicator for eating places, as this demographic group represents nearly all of spending within the trade.

In keeping with information from the Bureau of Labor Statistics, households with incomes of $200,000 or increased are accountable for 24% of the full spending on meals away from residence, whereas households with incomes between $100,000 and $199,999 account for 33% of trade spending.

Taken collectively, households with earnings above $100,000 are accountable for practically 6 in 10 {dollars} spent in eating places.

*Consuming and ingesting locations are the first element of the U.S. restaurant and foodservice trade and symbolize roughly 75% of complete restaurant and foodservice gross sales. Month-to-month gross sales figures introduced above symbolize complete revenues in any respect consuming and ingesting place institutions. This differs from the Nationwide Restaurant Affiliation’s gross sales projections, which symbolize meals and beverage gross sales at institutions with payroll workers.

Learn extra analysis and commentary from the Affiliation’s economists, together with the most recent outlook for consumers and the economy.