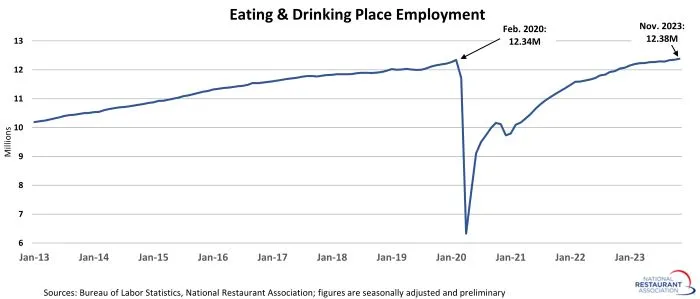

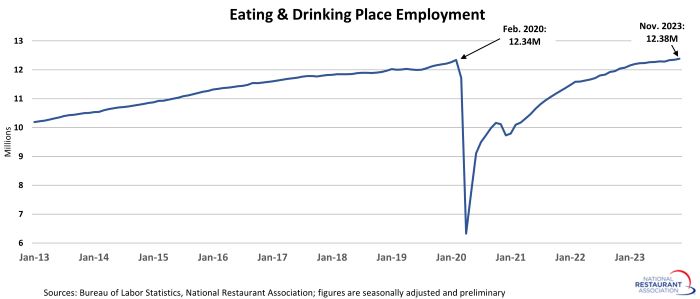

Restaurant job progress was uneven in current months, however the newest knowledge suggests the trade lastly returned to pre-pandemic employment ranges in November. That was considered the case in September, earlier than the preliminary knowledge was revised sharply decrease.

Consuming and consuming locations* added a internet 38,300 jobs in November on a seasonally-adjusted foundation, in response to preliminary knowledge from the Bureau of Labor Statistics (BLS). That adopted upward-revised beneficial properties in each September and October.

Together with November’s enhance, consuming and consuming locations have now added greater than 6 million jobs because the pandemic trough of restaurant employment in April 2020. As of November 2023, consuming and consuming locations are 46,000 jobs above their February 2020 employment peak.

Fullservice section nonetheless down over 200k jobs

Total restaurant employment surpassed pre-pandemic ranges, however the extent of the trade’s restoration varies considerably by section. [Note that the segment-level employment figures are lagged by one month, so October is the most current data available.]

The fullservice section skilled probably the most job losses through the preliminary months of the pandemic – and it nonetheless has the longest path to restoration. As of October 2023, fullservice restaurant employment ranges have been 205,000 jobs (or 4%) beneath pre-pandemic readings in February 2020.

Employment counts within the cafeterias/grill buffets/buffets section (-33%) additionally remained beneath their February 2020 ranges.

Job losses within the limited-service segments have been considerably much less extreme through the preliminary months of the pandemic, as these operations have been extra more likely to retain workers to help their present off-premises enterprise. As of October 2023, employment at snack and nonalcoholic beverage bars – together with espresso, donut and ice cream retailers – was 106,000 jobs (or 13%) above February 2020 readings.

Staffing ranges within the quickservice and quick informal segments have been 119,000 jobs (or 3%) above pre-pandemic ranges. Headcounts at bars and taverns have been 51,000 jobs (or 12%) above the pre-pandemic peak.

23 states beneath pre-pandemic employment ranges

The rebuilding of the trade workforce has additionally been uneven throughout states. As of October 2023, 23 states and the District of Columbia nonetheless had fewer consuming and consuming place jobs than they did in October 2019.

This group was led by Maryland, which had 9% fewer consuming and consuming place jobs in October 2023 than it did in October 2019. Maine (-8%), Vermont (-7%), Michigan (-6%) and Massachusetts (-6%) have been additionally effectively beneath their pre-pandemic restaurant employment ranges.

As of October 2023, consuming and consuming place employment in 27 states surpassed their comparable pre-pandemic readings in October 2019. This group was led by Nevada (+15%), Utah (+13%), Idaho (+12%) and Montana (+9%).

[Note that the state-level analysis uses October 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available.]

View the newest employment data for each state.

*Consuming and consuming locations are the first element of the full restaurant and foodservice trade, which previous to the COVID-19 pandemic employed greater than 12 million out of the full restaurant and foodservice workforce of 15.6 million.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.