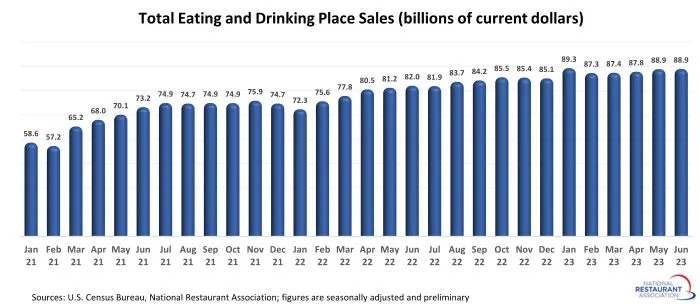

Consuming and consuming locations* registered complete gross sales of $88.9 billion on a seasonally adjusted foundation in June, in accordance with preliminary knowledge from the U.S. Census Bureau. That was primarily unchanged from Might’s gross sales quantity, which was revised greater by almost $1 billion from preliminary readings.

The plateauing of restaurant gross sales mirrored the broader retail panorama in June, as shopper spending in non-restaurant retail sectors rose simply 0.2%.

Nevertheless, the trendline of restaurant gross sales was considerably extra optimistic when in comparison with year-ago ranges. Shopper spending in eating places elevated 8.4% between June 2022 and June 2023, whereas complete spending in non-restaurant retail sectors edged up 0.5%.

Whereas the general trajectory of restaurant gross sales was optimistic in latest months, the first catalyst was greater menu costs. In inflation-adjusted phrases, consuming and consuming place gross sales rose simply 0.7% between June 2022 and June 2023.

*Consuming and consuming locations are the first element of the U.S. restaurant and foodservice trade, which previous to the coronavirus pandemic generated roughly 75% of complete restaurant and foodservice gross sales. Month-to-month gross sales figures offered above symbolize complete revenues in any respect consuming and consuming place institutions. This differs from the Nationwide Restaurant Affiliation’s gross sales projections, which symbolize meals and beverage gross sales at institutions with payroll workers.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.