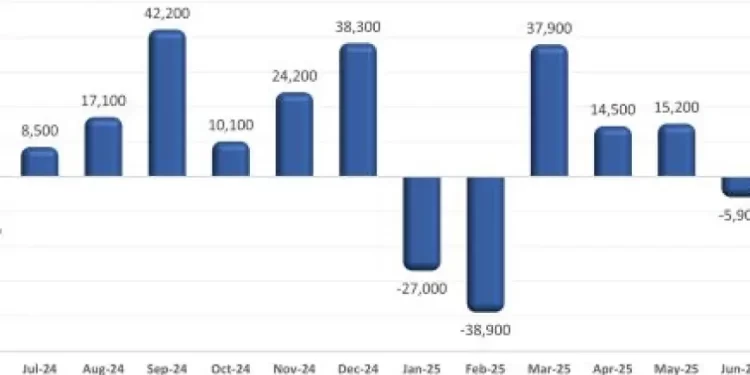

Restaurant job progress rediscovered some momentum within the third quarter – rebounding from a sluggish first half of the 12 months.

Consuming and consuming locations* added a internet 36,500 jobs in September on a seasonally-adjusted foundation, in keeping with preliminary information from the Bureau of Labor Statistics (BLS). That represented the strongest month-to-month employment improve in 6 months and the second-largest acquire of the 12 months so far.

In whole, eating places added almost 68,000 jobs within the third quarter, because the July and August readings had been additionally revised increased. That was a stable enchancment from the modest outcomes in the course of the first (-28,000) and second (+23,800) quarters of the 12 months.

To make sure, restaurant job progress continues to be considerably dampened in 2025 in comparison with latest years, however the slowdown was a lot much less extreme than the preliminary information steered. The trade stays on tempo so as to add greater than 100k jobs throughout 2025, which might mark the fifth consecutive 12 months above that degree.

The third quarter’s acceleration in job progress pushed the dimensions of the restaurant workforce additional above pre-pandemic ranges. As of September 2025, consuming and consuming place employment was almost 144,000 jobs (or 1.2%) above its February 2020 degree.

Fullservice phase stays 212k jobs beneath pre-pandemic ranges

Inside the restaurant trade, the limited-service segments proceed to set the tempo when it comes to job progress.

The espresso and snack phase has led the way in which all through the restoration from pandemic-induced job losses. As of August 2025, employment at snack and nonalcoholic beverage bars – together with espresso, donut and ice cream retailers – was 184,000 jobs (or 23%) above February 2020 readings.

Worker counts at quickservice and quick informal eating places had been 107,000 jobs (or 2.4%) above pre-pandemic ranges.

In distinction, fullservice restaurant employment ranges remained 212,000 jobs (or 3.7%) beneath pre-pandemic readings, as of August 2025.

[Note that the segment-level employment figures are lagged by one month, so August 2025 is the most current data available.]

Restaurant job progress uneven throughout states

Greater than 5 years after the onset of the pandemic within the U.S., restaurant staffing ranges stay beneath pre-pandemic readings in 17 states and the District of Columbia.

This group was led by Massachusetts and West Virginia, which had about 5% fewer consuming and consuming place jobs within the second quarter of 2025 than they did within the second quarter of 2019. Maryland (-4%), Illinois (-3%), California (-3%), Vermont (-3%) and Michigan (-3%) had been additionally effectively beneath their pre-pandemic restaurant employment ranges.

In distinction, restaurant employment in a number of of the mountain states has climbed effectively past pre-pandemic ranges. This group is led by Idaho (+17%), Utah (+15%), South Dakota (+14%) and Nevada (+13%).

[Note that the state-level analysis uses 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available for every state.]

View the most recent employment data for each state.

Word: Consuming and consuming locations are the first element of the full restaurant and foodservice trade, offering jobs for roughly 80% of the full restaurant and foodservice workforce of greater than 15.7 million.

Observe extra economic indicators and skim extra analysis and commentary from the Affiliation’s economists.