The restaurant trade continued to broaden payrolls at a wholesome tempo in March. Consuming and ingesting locations* added a internet 50,300 jobs in March on a seasonally-adjusted foundation, in accordance with preliminary information from the Bureau of Labor Statistics (BLS).

The March enhance got here on the heels of strong features in January (81,500) and February (60,200). In every month through the first quarter of 2023, consuming and ingesting locations have been the non-public sector’s prime job creator.

March marked the twenty seventh consecutive month of employment features within the restaurant trade – representing a complete enhance of greater than 2.5 million jobs. That’s 300,000 extra jobs than the subsequent closest trade added over the past 27 months (skilled and enterprise providers – 2.2 million jobs).

Pushed by the regular features, the restaurant workforce is inching nearer to a full restoration to pre-pandemic ranges. As of March 2023, consuming and ingesting locations have been 75,000 jobs – or 0.6% – under their February 2020 employment peak.

Fullservice phase has the biggest deficit from pre-pandemic staffing ranges

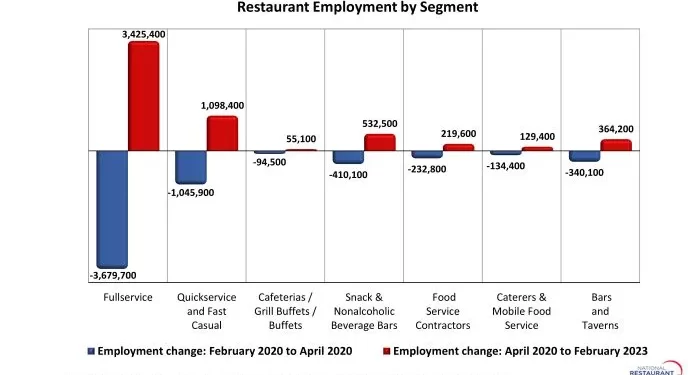

The restaurant employment restoration continues to range considerably by phase. [Note that the segment-level employment figures are lagged by one month, so February is the most current data available.]

The fullservice phase skilled probably the most job losses through the preliminary months of the pandemic – and it nonetheless has the longest path to restoration. As of February 2023, fullservice restaurant employment ranges have been 254,000 jobs (or 5%) under pre-pandemic readings in February 2020.

Employment counts within the cafeterias/grill buffets/buffets phase (-36%), foodservice contractor phase (-3%) and catering and cellular foodservice phase (-2%) additionally stay under their February 2020 ranges.

Job losses within the limited-service segments have been considerably much less extreme through the preliminary months of the pandemic, as these operations have been extra prone to retain employees to help their present off-premises enterprise. As of February 2023, employment at snack and nonalcoholic beverage bars – together with espresso, donut and ice cream retailers – was 122,000 jobs (or 15%) above February 2020 readings.

Staffing ranges within the quickservice and quick informal segments have been practically 53,000 jobs (or 1%) above pre-pandemic ranges. Headcounts at bars and taverns have been 24,000 jobs (or 6%) above the pre-pandemic peak.

*Consuming and ingesting locations are the first part of the overall restaurant and foodservice trade, which previous to the coronavirus outbreak employed greater than 12 million out of the overall restaurant and foodservice workforce of 15.6 million.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.