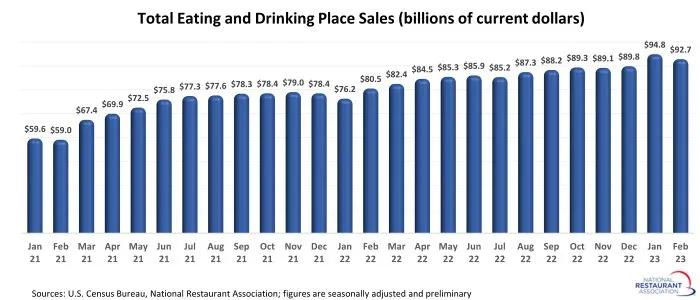

Consuming and ingesting locations registered complete gross sales of $92.7 billion on a seasonally adjusted foundation in February, in response to preliminary knowledge from the U.S. Census Bureau.

Whereas that was down greater than $2 billion from January’s downward-revised studying of $94.8 billion, it was practically $3 billion above December’s seasonally-adjusted gross sales quantity of $89.8 billion.

The seasonally-adjusted gross sales readings in January and February have been nicely above the trendline established in 2022. Whereas this may very well be partially as a result of affect of atypical seasonal elements, the unadjusted knowledge continued to point out optimistic outcomes in comparison with year-ago ranges.

Taken collectively, complete consuming and ingesting place gross sales in January and February have been greater than 19% above the primary two months of 2022.

Pent up demand ticked decrease

Coinciding with an uptick in gross sales throughout the first two months of the 12 months, the Nationwide Restaurant Affiliation’s measures of pent-up demand edged decrease. Forty-one % of adults say they don’t seem to be going out to eating places as typically as they want, in response to a survey fielded March 10-12, 2023. That was the bottom stage reported since earlier than the pandemic.

In the meantime, 33% of adults say they don’t seem to be ordering takeout or supply from eating places as typically as they want. That was basically on par with customers’ reporting in surveys fielded in Could 2022 and September 2022.

Members of Technology X are the most probably to say they aren’t utilizing eating places sufficient. Fifty-three % of Gen Xers say they don’t seem to be consuming on premises at eating places as typically as they want. Lower than 4 in 10 child boomers, millennials and Gen Z adults reported equally.

Gen Xers (42%) are additionally the most probably to say they don’t seem to be ordering takeout or supply from eating places as typically as they want.

*Consuming and ingesting locations are the first part of the U.S. restaurant and foodservice trade, which previous to the coronavirus pandemic generated roughly 75% of complete restaurant and foodservice gross sales. Month-to-month gross sales figures introduced above characterize complete revenues in any respect consuming and ingesting place institutions.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.