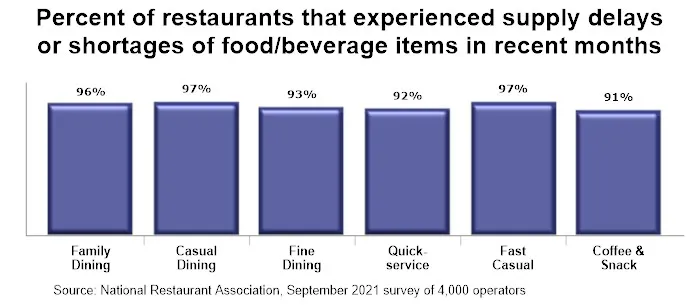

Greater than 9 in 10 restaurant operators skilled provide delays or shortages of key meals or beverage objects in latest months.

The restaurant business is not being spared from the array of provide chain points which can be at present impacting many sectors throughout the economic system. In a September 2021 survey fielded by the Affiliation, 95% of operators stated their restaurant skilled provide delays or shortages of key meals or beverage objects in latest months.

The impression was felt throughout all kinds of eating places, with greater than 9 in 10 operators throughout every of the foremost segments reporting provide delays or shortages in latest months.

Affect on menus

For a lot of eating places, these provide challenges altered what they may provide to prospects. Amongst operators that skilled provide delays or shortages in latest months, 75% stated they made modifications to their menu choices in consequence.

Tableservice restaurant menus have been the probably to be impacted by the latest provide chain challenges. Eighty-eight % of advantageous eating operators and 81% of informal eating operators stated their restaurant modified menu choices on account of meals provide delays or shortages.

Meals prices are hovering

On prime of the provision chain challenges, restaurant operators are paying increased costs for a lot of of their meals objects. Within the Affiliation’s September 2021 survey, 91% of operators stated their whole meals prices (as a % of gross sales) are increased than they have been previous to the COVID-19 outbreak. Solely 3% stated their meals prices make up a smaller proportion of gross sales.

Operators’ reporting of rising meals prices was confirmed by the most recent wholesale value information from the Bureau of Labor Statistics. The Producer Worth Index for All Meals – which represents the change in common costs paid to home producers for his or her output – jumped 12.9% between September 2020 and September 2021. That represented the strongest 12-month enhance in additional than 4 many years.

Profitability is down

Due largely to hovering meals prices, profitability is down from pre-pandemic ranges for the overwhelming majority of eating places. Within the Affiliation’s September 2021 survey, 85% of operators stated their revenue margin is decrease than it was previous to the COVID-19 outbreak. Solely 5% of operators stated their revenue margin is increased.

Most operators additionally reported a deterioration of profitability throughout the previous few months. Total, 65% of operators stated their restaurant was much less worthwhile in September than it was in June. Solely 6% of operators stated their restaurant was extra worthwhile than it was 3 months earlier.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.