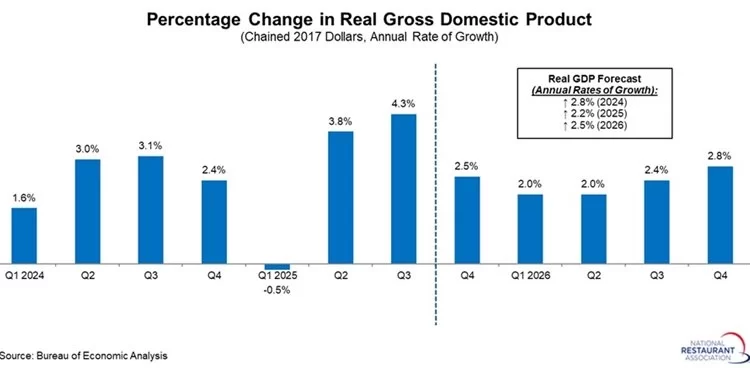

The U.S. economic system expanded at a powerful 4.3% annual price within the third quarter of 2025, in accordance with an estimate delayed by the federal government shutdown. This marks the quickest tempo of development since Q3 2023 and builds on the stable 3.8% achieve within the second quarter, following a 0.5% contraction earlier within the 12 months.

Whereas actual GDP has been considerably “noisy” in 2025—pushed partially by commerce volatility—each customers and companies have grown extra cautious. Even so, the economic system has proven notable resilience, with again‑to‑again strong output readings in Q2 and Q3. Beneath the headline figures, nevertheless, considerations stay. Enterprise funding softened, suggesting hesitancy on the a part of companies, and shopper spending patterns level to elevated selectivity. This mirrors what we hear from restaurant operators and customers.

Wanting forward, the Nationwide Restaurant Affiliation expects continued development, with actual GDP projected to rise 2.2% in 2025 and a couple of.5% in 2026—a forecast that displays regular momentum regardless of persistent draw back dangers.

Shopper spending remained a vibrant spot, particularly in companies and nondurable items. Private consumption expenditures rose at a 3.5% annual price—the strongest tempo since late final 12 months—and contributed 2.39 proportion factors to general GDP development. Even so, spending at foodservices and lodging added simply 0.06 proportion factors, down from a 0.28‑level contribution within the second quarter.

Funding exercise improved however was a slight drag on development. Mounted funding slowed from a 4.4% annualized achieve in Q2 to only 1.0% in Q3, with nonresidential fastened funding easing from 7.3% to 2.8%. Gear and mental property funding each held up effectively, every rising 5.4%, however constructions spending declined for the seventh consecutive quarter. In the meantime, residential funding fell for the third straight quarter, and companies continued to attract down inventories for the second quarter in a row.

Web exports added 1.59 proportion factors to actual GDP within the third quarter, making it the second‑largest contributor after service-sector spending. This enhance primarily mirrored a pointy drop in imports, which fell 4.7% at an annual price. Exports strengthened, rising 8.8% within the quarter.

Authorities spending contributed a further 0.39 proportion factors to headline development. Federal outlays elevated 2.9% in Q3 after notable declines within the first half of the 12 months, pushed largely by larger nationwide protection spending. Nondefense outlays fell for the third consecutive quarter. In the meantime, state and native authorities spending additionally moderated, easing from a 3.1% achieve in Q2 to 1.8% in Q3.