With on-premises capability restricted – and generally nonexistent – in the course of the pandemic, restaurant operators had no selection however to sharpen their concentrate on off-premises enterprise. This was notably true within the fullservice phase, with roughly one-half of operators saying they devoted extra assets to increasing the off-premises aspect of their enterprise for the reason that starting of the COVID-19 outbreak in March 2020.

As eating places added new off-premises choices in latest months, customers responded by growing their utilization of takeout and supply. Nationwide Restaurant Affiliation survey knowledge reveals {that a} increased proportion of customers are ordering off-premises meals from eating places than earlier than the pandemic – particularly for the lunch and dinner dayparts.

Previous to the coronavirus lockdowns, slightly below 60% of adults stated they ordered takeout or supply from a restaurant for his or her dinner meal in the course of the earlier week, based on weekly surveys performed by the Affiliation. Over the past 9 months, a median of 65% of adults ordered takeout or supply for dinner on a weekly foundation.

The pattern is comparable for the lunch daypart. During the last 9 months, a median of 46% of adults ordered takeout or supply for his or her lunch meal in the course of the earlier week. In early March, solely 37% of adults reported equally.

Not filling the on-premises void

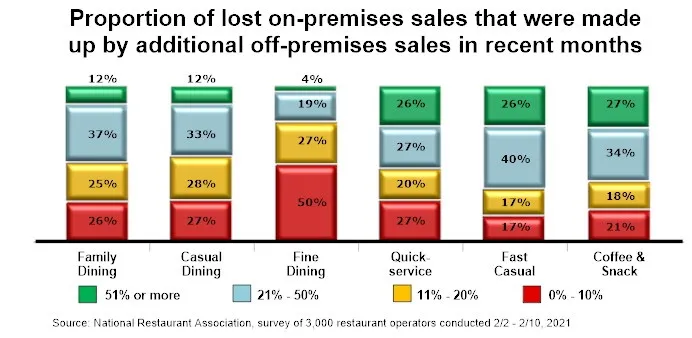

Throughout every of the six main business segments, off-premises represents a bigger proportion of gross sales than it did pre-COVID. Nevertheless, for the overwhelming majority of operators, this wasn’t practically sufficient to offset their on-premises gross sales losses.

This was notably true within the positive eating phase. Amongst positive eating operators who say their off-premises enterprise elevated in comparison with pre-COVID ranges, 77% say their further off-premises gross sales have made up lower than 20% of their misplaced on-premises gross sales. Totally one-half of positive eating operators say their increased off-premises gross sales have made up lower than 10% of their misplaced on-premises gross sales. In the meantime, solely 4% of positive eating operators say their added off-premises gross sales recovered greater than half of their misplaced on-premises enterprise.

Within the household eating and informal eating segments, simply over one-half of operators say their further off-premises gross sales made up lower than 20% of their misplaced on-premises enterprise.

Outcomes have been considerably extra favorable within the limited-service phase, with roughly one in 4 operators saying their further off-premises gross sales made up greater than half of their misplaced on-premises enterprise. Nonetheless, most limited-service operators say it was solely sufficient to offset a fraction of their on-premises gross sales shortfall.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.