Though consuming and ingesting place gross sales rose in January for the primary time in 4 months, month-to-month quantity remained $11 billion – or greater than 16% – beneath pre-coronavirus ranges. January’s gross sales achieve was a step in the precise course, however the business’s street to restoration stays lengthy.

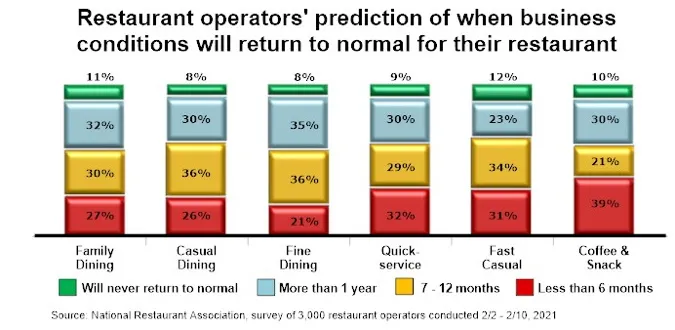

For his or her half, most restaurant operators don’t anticipate a fast return to a traditional enterprise surroundings, in keeping with a Nationwide Restaurant Affiliation survey carried out February 2-10, 2021.

General, 32% of operators assume it is going to be 7-12 months earlier than enterprise circumstances return to regular for his or her restaurant, whereas 29% assume it is going to be greater than a yr. A further 10% of operators say enterprise circumstances will by no means return to regular for his or her restaurant.

It’s vital to notice {that a} return to regular enterprise circumstances doesn’t essentially imply a full restoration to pre-coronavirus gross sales ranges. Reasonably, it displays an operational surroundings that doesn’t embody indoor eating restrictions, in addition to a vaccinated populace that feels assured going out to public locations.

On the phase stage, effective eating operators envision the longest timeline to a traditional working surroundings. Seventy-one % of effective eating operators assume it is going to be not less than 7 months earlier than enterprise circumstances return to regular for his or her restaurant. Eight % don’t assume it should ever occur.

Whereas the time horizon is considerably shorter for limited-service operators, it nonetheless gained’t occur in a single day. Solely 3 in 10 quickservice and quick informal operators – and 39% of espresso and snack idea operators – assume enterprise circumstances will return to regular throughout the subsequent 6 months.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.