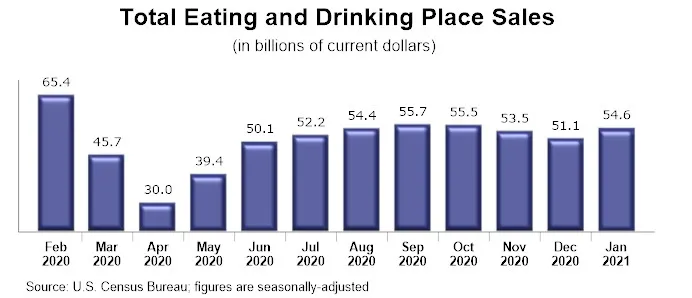

After trending sharply decrease on the finish of 2020, restaurant gross sales bounced again with a wholesome acquire in January. Consuming and consuming locations* registered gross sales of $54.6 billion on a seasonally-adjusted foundation in January, based on preliminary information from the U.S. Census Bureau.

That was up 6.9% from December’s gross sales quantity of $51.1 billion, and represented the most important month-to-month enhance since June. Nevertheless, it wasn’t sufficient to make up for the 8.3% drop in gross sales throughout the ultimate three months of 2020.

January’s gross sales acquire was a step in the proper path, however the restaurant business’s highway to restoration stays lengthy. General, consuming and consuming place gross sales in January nonetheless stood practically $11 billion – or greater than 16% – beneath their pre-coronavirus ranges in January and February.

Whereas January’s gross sales acquire was a lot wanted, most restaurant operators stay unsure if it will likely be sustained within the weeks forward. Solely 16% of fullservice operators anticipate to have larger gross sales in February or March than they did in January. Forty-six % assume their gross sales will decline from January’s degree.

Restricted-service operators are solely barely extra optimistic concerning the subsequent a number of weeks. Twenty-one % of limited-service operators assume their gross sales in February and March will likely be larger than January; 37% anticipate to have decrease gross sales.

Winter is right here

Eating places misplaced an vital buyer touchpoint throughout the latest surge in winter climate, with out of doors eating turning into much less possible in lots of components of the nation. This had been a lifeline for a lot of eating places, significantly in areas that ramped up indoor eating restrictions in latest months.

Solely 42% of fullservice operators say their restaurant at present gives on-premises out of doors eating in an area comparable to a patio, deck or sidewalk, based on a Nationwide Restaurant Affiliation survey performed February 2-10, 2021. That’s down from 52% in November and 74% in September.

Within the limited-service phase (quickservice, quick informal and occasional/snack ideas), 37% of operators say they at present provide out of doors eating – down from 46% in November and 60% in September.

*Consuming and consuming locations are the first part of the U.S. restaurant and foodservice business, which previous to the coronavirus outbreak generated roughly 75 % of whole restaurant and foodservice gross sales.

Learn extra evaluation and commentary from the Affiliation’s chief economist Bruce Grindy.