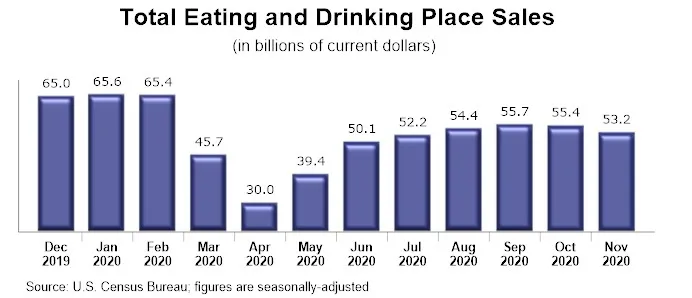

Restaurant gross sales fell sharply for the second consecutive month in November, as enterprise circumstances for the business proceed to deteriorate. Consuming and ingesting locations* registered gross sales of $53.2 billion on a seasonally-adjusted foundation in November, in accordance with preliminary knowledge from the U.S. Census Bureau.

That was down $2.2 billion (or 4%) from October’s quantity of $55.4 billion, and represented the business’s lowest month-to-month gross sales whole since July.

This implies the restaurant gross sales restoration has not solely stalled, however that the business has seemingly fallen right into a double-dip recession. Consuming and ingesting place gross sales stay greater than $12 billion – or 19% – beneath their pre-coronavirus ranges in January and February.

One purpose for the deteriorating enterprise circumstances is the top of the outside eating season in lots of components of the nation. In late November, 52% of fullservice operators mentioned their restaurant supplied on-premises outside eating in an area similar to a patio, deck or sidewalk. That was down from 74% in early September. Forty-six p.c of limited-service operators supplied outside eating in late November – down from 60% in September.

Although a large variety of eating places proceed to present prospects the choice of consuming outdoors, there’s a large distinction between providing outside seating and having a packed patio. With chilly climate descending on a lot of the nation, an growing variety of outside tables are sitting empty.

Whereas the rollout of the vaccine offers a glimmer of sunshine on the finish of the tunnel, it will likely be a number of extra months earlier than enterprise circumstances even start to resemble regular for eating places. With that in thoughts, a powerful majority of restaurant operators are pessimistic about their gross sales prospects throughout the winter months.

Eighty-three p.c of fullservice operators anticipate their gross sales to lower from present ranges throughout the subsequent 3 months, whereas solely 3% assume their gross sales will improve. Amongst limited-service operators, 67% assume their gross sales will decline throughout the subsequent 3 months; solely 9% anticipate gross sales to rise.

Whereas the Census Bureau’s seasonally-adjusted figures provide a directional have a look at spending tendencies from month to month, they don’t present an entire image of the gross sales losses which were skilled by eating places throughout the coronavirus pandemic. For this, the unadjusted knowledge set is a greater measure, as a result of it represents the precise {dollars} coming within the door.

In whole between March and November, consuming and ingesting place gross sales have been down almost $192 billion from anticipated ranges, based mostly on the unadjusted knowledge. Add within the sharp discount in spending at non-restaurant foodservice operations within the lodging, arts/leisure/recreation, schooling, healthcare and retail sectors, and the whole shortfall in restaurant and foodservice gross sales seemingly reached $235 billion over the last 9 months.

*Consuming and ingesting locations are the first element of the U.S. restaurant and foodservice business, which previous to the coronavirus outbreak generated roughly 75 p.c of whole restaurant and foodservice gross sales.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.