The restaurant trade has been hit onerous by the coronavirus pandemic, with restaurant and foodservice sales losses surpassing $185 billion between March and August. Nevertheless, with out the growth of off-premises enterprise in eating places throughout all segments, the influence would have been a lot worse.

To spice up their off-premises enterprise, many restaurant operators added new choices for his or her prospects. The commonest addition is curbside takeout, which was added by 67% of operators for the reason that starting of the COVID-19 outbreak in March. That’s based on a survey of three,500 restaurant operators carried out by the Nationwide Restaurant Affiliation August 26 – September 1.

Twenty-seven % of operators say they added third-party supply, whereas 17% added in-house supply. Three % of operators say they added a drive-thru possibility since March. Among the many restaurant operators that added any of those off-premises choices, a majority say they plan to proceed providing it after COVID-19 passes.

Because of this, 71% of operators say off-premises gross sales at the moment symbolize the next proportion of their whole enterprise than they did previous to the COVID-19 outbreak. Whereas this doesn’t come shut to creating up for misplaced on-premises gross sales for many eating places, it supplies a possible alternative to assist keep afloat till the coronavirus clouds half.

Shoppers responded

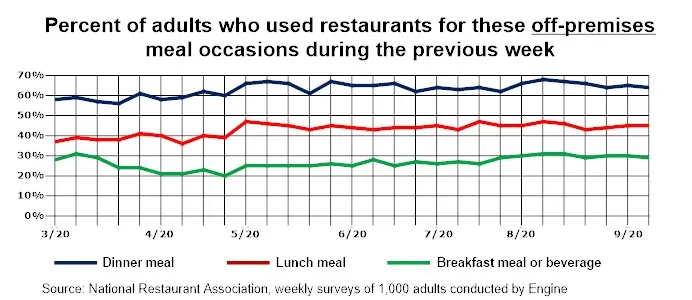

Due largely to those added choices, the next proportion of shoppers are ordering off-premises meals from eating places than earlier than the pandemic – notably for the lunch and dinner dayparts.

Previous to the coronavirus lockdowns, just below 60% of adults stated they ordered takeout or supply from a restaurant for his or her dinner meal through the earlier week, based on weekly surveys carried out by the Nationwide Restaurant Affiliation. Over the past 4 months, a mean of 65% of adults ordered takeout or supply for dinner on a weekly foundation.

The pattern is analogous for the lunch daypart. During the last 4 months, a mean of 45% of adults ordered takeout or supply for his or her lunch meal through the earlier week. In early March, solely 37% of adults reported equally.

Through the early weeks of the coronavirus lockdowns, solely about one in 5 adults stated they picked up a breakfast meal or beverage from a restaurant or espresso store through the week. This was down about 10 proportion factors from pre-coronavirus ranges, and certain as a result of the truth that many individuals weren’t going into work. Nevertheless, in current weeks, this proportion returned to pre-COVID ranges of about 30%.

Pent-up demand divergence

The uptick in off-premises utilization is mirrored within the consumer-reported measures of pent-up demand tracked by the Affiliation. In mid-January, 44% of adults stated they weren’t ordering takeout or supply from eating places as usually as they want. This rose to 52% in late April, after which trended decrease in current months to settle at simply 36% by early September.

Not surprisingly, the story is sort of totally different for shoppers’ on-premises utilization of eating places. In late April, 83% of adults stated they weren’t consuming on-premises at eating places as usually as they want. This was up sharply from 45% in mid-January, and was simply the best stage ever recorded within the twenty years that the Affiliation has been fielding this survey query.

Whereas this measure of pent-up demand drifted considerably decrease to a stage of 71% in early September, it clearly signifies that customers can be visiting eating places extra incessantly if they may.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.