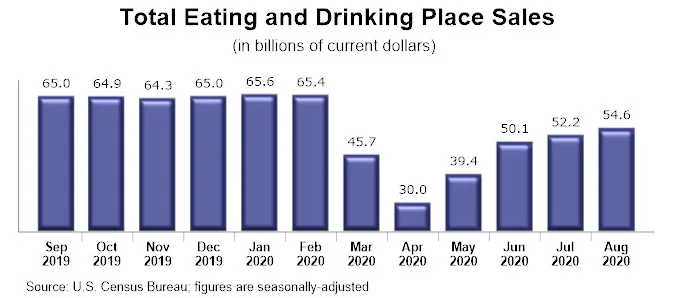

After the preliminary gross sales bounce that adopted the government-mandated lockdowns throughout the early weeks of the coronavirus outbreak, shopper spending in eating places slowed throughout the peak summer season months. Consuming and ingesting locations* posted gross sales of $54.6 billion on a seasonally-adjusted foundation in August, in line with preliminary knowledge from the U.S. Census Bureau.

Whereas the gross sales beneficial properties in July (4.1%) and August (4.7%) continued to level the trendline in a optimistic route, they had been properly under the strong progress registered in Might (31.3%) and June (27.2%). In consequence, complete gross sales in August had been nonetheless almost $11 billion decrease than the pre-coronavirus ranges posted in January and February.

Whereas the seasonally-adjusted figures provide a directional take a look at spending tendencies from month to month, they don’t present an entire image of the gross sales losses which were skilled by eating places throughout the coronavirus pandemic. For this, the Census Bureau’s unadjusted knowledge set is a greater measure, as a result of it represents the precise {dollars} coming within the door.

In complete between March and August, consuming and ingesting place gross sales ranges had been down greater than $148 billion from anticipated ranges, based mostly on the unadjusted knowledge. Add within the sharp discount in spending at non-restaurant foodservice operations within the lodging, arts/leisure/recreation, schooling, healthcare and retail sectors, and the overall shortfall in restaurant and foodservice gross sales doubtless surpassed $185 billion over the past six months.

August challenges

Regardless of the gross sales enhance in August, restaurant operators should not in settlement that total enterprise situations are on the upswing. Actually, by a higher than two to 1 margin, operators usually tend to say enterprise situations worsened in August moderately than get higher. That’s in line with a survey of three,500 restaurant operators performed by the Nationwide Restaurant Affiliation August 26 – September 1.

Thirty-two % of fullservice restaurant operators say enterprise situations in August had been worse than they had been in July, whereas solely 14% say enterprise situations improved in August. Fifty-four % of fullservice operators say enterprise situations in August had been about the identical as they had been in July.

Operators’ evaluation of enterprise situations is analogous within the broadly outlined limited-service phase, which incorporates quickservice, quick informal, and occasional and snack ideas. Solely 13% of limited-service operators say enterprise situations improved in August from July, whereas 30% say they worsened.

Rocky roads forward

Wanting forward, most restaurant operators don’t anticipate a speedy return to regular. Seventy-one % of fullservice operators say they don’t anticipate their restaurant’s gross sales to return to pre-coronavirus ranges throughout the subsequent six months. Fifty-four % of their limited-service counterparts report equally.

For a lot of eating places, treading water merely received’t get it carried out. Forty-three % of fullservice operators say it’s unlikely their restaurant will nonetheless be in enterprise six months from now, if enterprise situations proceed at present ranges. Amongst limited-service operators, one-third say they doubtless received’t survive one other six months if enterprise situations don’t enhance.

*Consuming and ingesting locations are the first element of the U.S. restaurant and foodservice trade, which previous to the coronavirus outbreak generated roughly 75 % of complete restaurant and foodservice gross sales.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.