Amid rising tariffs and shifting international provide chains, restaurant operators are additionally watching forex markets. Usually, increased U.S. tariffs coincide with a stronger greenback, as demand for U.S. forex rises to cowl the added import prices—serving to to offset a number of the impression.

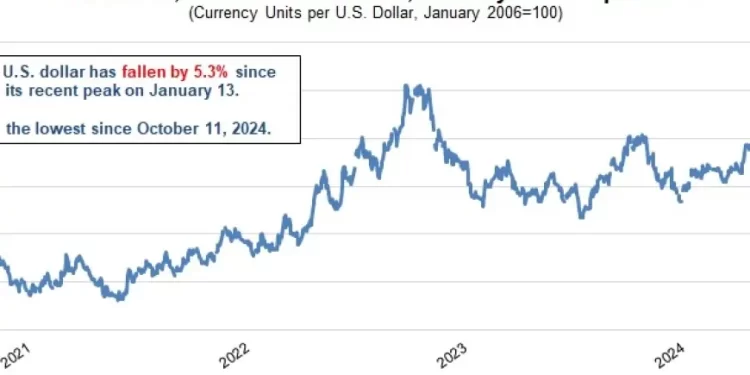

However the reverse has occurred in latest months. Since peaking on January 13, the U.S. greenback has declined 5.3% towards a broad, trade-weighted index of world currencies, in response to the Federal Reserve. As a result of this index displays the worth of different currencies per U.S. greenback, the drop means the greenback buys much less as we speak than it did in mid-January.

For eating places, this provides a second layer of price stress: not solely are tariffs elevating costs on imports, however the weaker greenback makes these items—comparable to meals, drinks, gear, and provides—much more costly.

(To be honest, the U.S. greenback is basically flat relative to the place it was one 12 months in the past, reflecting the appreciation within the forex seen lately.)

On the upside, a weaker greenback improves the buying energy of international guests, making the U.S. a extra engaging vacation spot. That would profit eating places in main vacationer hubs.

Nevertheless, worldwide journey has moved within the unsuitable course up to now this 12 months. In March, 4.54 million international vacationers arrived by air—down 9.7% from 5.03 million a 12 months earlier, in response to the Worldwide Commerce Administration. This will probably be an essential development to look at, particularly for eating places that depend on vacationer visitors.