The personal consumption expenditures deflator—the Federal Reserve’s most popular inflation measure—rose 0.3% in March, extending the 0.4% and 0.3% positive aspects seen in January and February, respectively. Power costs elevated 1.2% in March, with meals prices flat for the month. Excluding meals and power, the core PCE deflator additionally elevated by 0.3% in March, the identical tempo as in February.

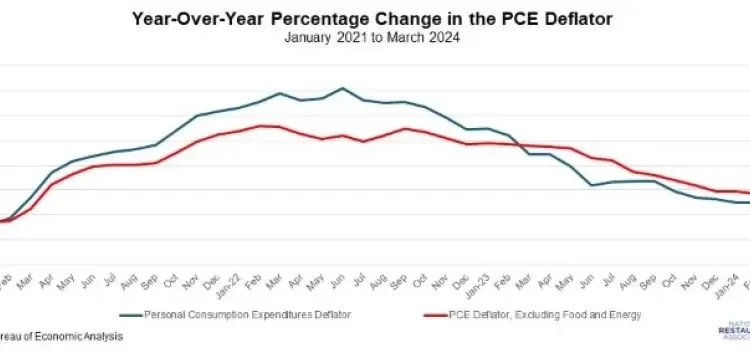

The PCE deflator has risen 2.7% since March 2023, up from 2.5% year-over-year in January and February. On the identical time, core inflation remained at 2.8% year-over-year in March for the second straight month. Total, these knowledge present that pricing pressures have moderated considerably over the previous couple of years, with the PCE deflator peaking at 7.1% year-over-year in June 2022 and core PCE inflation topping off at 5.5% in September of that yr.

But, progress has considerably stalled, with the core PCE deflator averaging 2.88% year-over-year over the previous 4 months. The Federal Open Market Committee’s said aim is for core inflation to be 2% over the long-term. Attending to that threshold—the so-called “final mile” within the battle in opposition to inflation—is proving to be difficult. Regardless of costs remaining considerably sticky, core PCE inflation is more likely to get nearer to the Fed’s goal by yr’s finish.

Till there’s extra progress on inflation, the Federal Reserve will probably be hesitant to drag again on rates of interest. With that in thoughts, the FOMC is more likely to stand pat in charges on the subsequent two conferences: April 30-Could 1 and June 11-12. Accordingly, the primary short-term fee reduce may come at one of many conferences after that: July 30-31 or September 17-18. After all, incoming knowledge would dictate whether or not such transfer(s) could be attainable. Monetary markets have reacted negatively in current weeks to the notion that there is perhaps fewer fee cuts in 2024 than was thought attainable even a month or two in the past.

In different features of the newest report, private consumption expenditures elevated 0.8% in March for the second consecutive month, with spending on foodservices and lodging up 0.5%. Within the first quarter, private spending rose 1.8%, with foodservice and lodging purchases up 1.0%. The year-over-year knowledge have been extra encouraging, illustrating why the U.S. economic system has remained so resilient, with private spending up 5.8% since March 2023 and foodservice and lodging spending leaping 7.2%.

Private incomes rose 0.5% in March, up from 0.3% in February. Wages and salaries elevated 0.7% for the month. Over the previous 12 months, wages and salaries have elevated 5.9%. With spending outpacing revenue progress, the private financial savings fee dropped to three.2% in March, the bottom since October 2022.

Learn extra evaluation and commentary from the Affiliation’s economists, together with the newest outlook for consumers and the economy.