A wholesome labor market, coupled with extra financial savings that households accrued in the course of the pandemic, allowed customers to proceed spending at a sturdy tempo final yr. Now that these financial savings are largely depleted, the resiliency of households is being examined in 2024.

The primary half of 2024 noticed moderating progress in each employment and wages, that are two key catalysts for family spending. Regardless of some current indicators of weak point, a continuation of the labor market growth would make it probably that customers will bend however not break in the course of the second half of the yr.

This text presents the newest tendencies in key indicators that influence customers’ potential and willingness to spend.

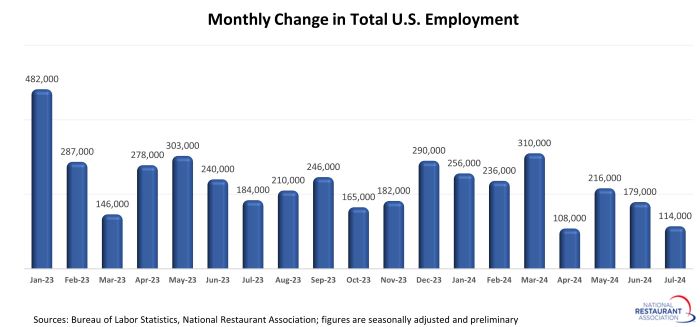

Labor market beginning to cool

Job progress is the first driver of client spending, and there are indicators that the labor market is starting to chill. The nationwide financial system added simply 114,000 jobs in July, which was down from the typical month-to-month beneficial properties of 217,500 jobs in the course of the first half of 2024. Though a deceleration in job progress is probably going in the course of the second half of 2024, the expectation is that employers will proceed to develop payrolls by means of the tip of the yr.

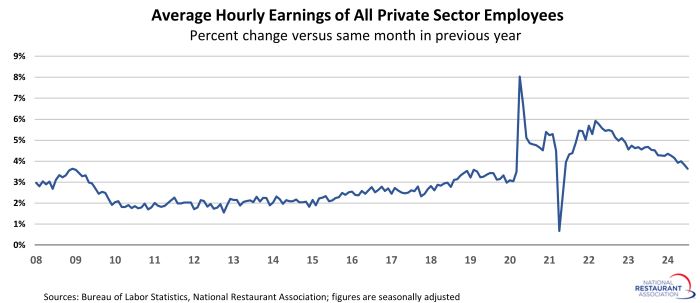

Wage progress is slowing

Together with slower job progress, wage beneficial properties are additionally down from their strong pandemic-era progress charges. Common hourly earnings of personal sector staff elevated 3.6% between July 2023 and July 2024. That was greater than 2 proportion factors beneath the robust beneficial properties posted throughout 2022, but it surely was nonetheless barely above the three.3% common achieve throughout 2019.

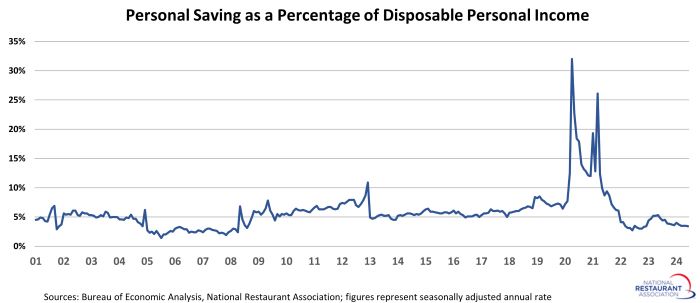

Financial savings charge dipped beneath pre-pandemic ranges

Family financial savings soared in the course of the first yr and a half of the pandemic, pushed primarily by lowered client exercise in addition to income-supporting fiscal stimulus packages. Many households used these extra financial savings to help elevated spending ranges in 2022, which blunted the influence of hovering inflation. Financial savings charges are actually beneath pre-pandemic ranges, which implies the monetary cushion that many households established in the course of the pandemic is being depleted.

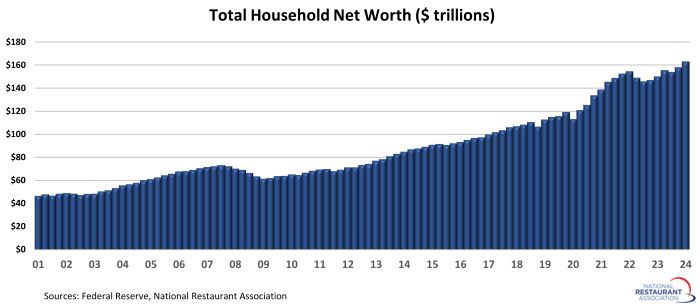

Family wealth at a document excessive

Family wealth rose to document highs in the course of the pandemic, pushed by a surging inventory market and accelerating house values. These two indicators reversed development in 2022, which resulted in a decline in whole family web value. By the primary quarter of 2024, whole family web value had rebounded to succeed in a brand new document excessive of greater than $160 trillion. Whereas family wealth doesn’t immediately decide the quantity that the majority customers can spend every day, its influence on confidence influences present and future monetary choices.

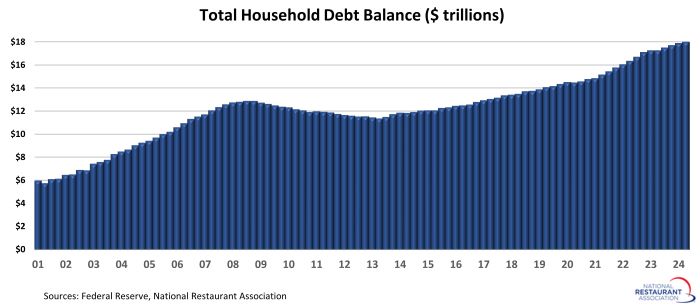

Family debt continues to rise

Family debt trended steadily increased in the course of the pandemic, with mixture balances reaching $17.8 trillion by 2024:Q2. That was $3.7 trillion increased than the 2019:This autumn stage. Mortgages characterize the majority of family debt at 70%, adopted by auto loans (9%) and pupil loans (9%).

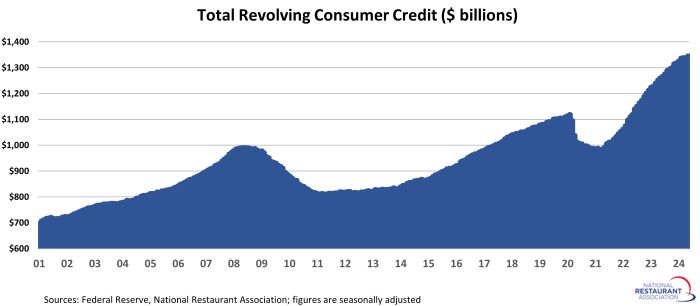

Revolving credit score rising sharply

Shopper credit score balances fell to a 4-year low in the course of the early months of the pandemic – primarily as a result of households had fewer locations to spend their cash. That development shortly reversed as restrictions eased and the financial system reopened. Revolving client credit score rose sharply in 2022 and 2023, wiping out all the steadiness reductions posted in the course of the early months of the pandemic. By Might 2024, whole revolving credit score balances topped $1.3 trillion – greater than $225 billion (or 20%) above their pre-pandemic peak.

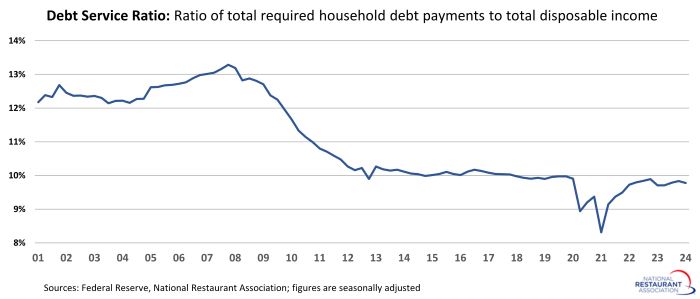

Debt service stays in examine

Regardless of the elevated debt ranges, debt service stays manageable for households on the combination. The Federal Reserve’s Debt Service Ratio, which is the ratio of whole required family debt funds to whole disposable revenue, was slightly below 10% in 2024:Q1. Whereas that was increased than the lows posted in the course of the first half of 2021, it was typically on par with pre-pandemic readings.

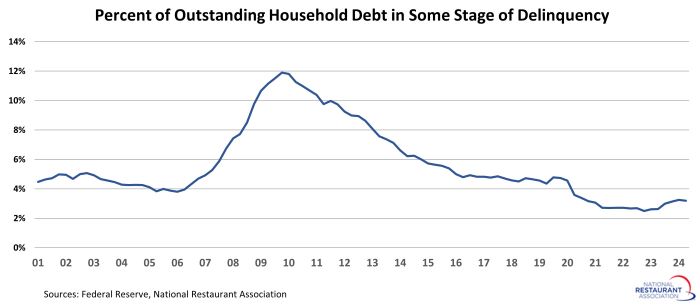

General delinquency charges are low

With debt service at manageable ranges, total delinquency charges stay in examine. As of 2024:Q2, solely 3.2% of excellent family debt was in some stage of delinquency. Whereas this was up 0.6 proportion factors from the 2023:Q2 stage, it remained effectively beneath the 2019 common of 4.6%.

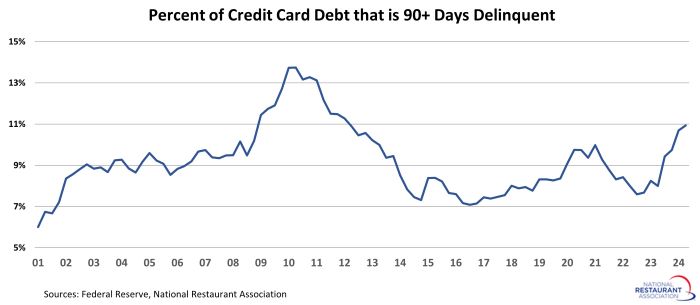

Bank card delinquencies rising sharply

General delinquency charges stay low, however the p.c of bank cards that have been severely delinquent rose sharply in current quarters. As of 2024:Q2, 10.9% of bank card debt was not less than 90 days delinquent. That was up from a current low of seven.6% in 2022:Q3 and represented the very best stage in additional than 12 years.

Learn extra analysis and commentary from the Nationwide Restaurant Affiliation’s economists, together with the newest outlook for the economy.