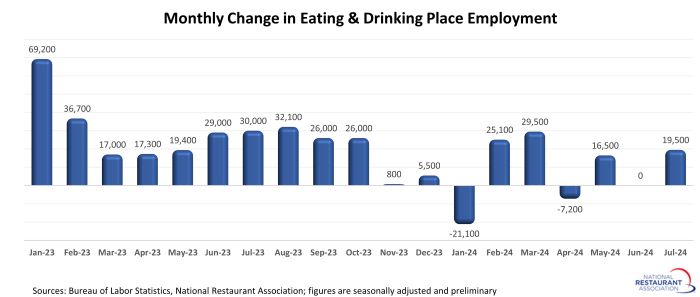

Consuming and consuming locations* added a web 19,500 jobs in July on a seasonally-adjusted foundation, in keeping with preliminary knowledge from the Bureau of Labor Statistics (BLS). That got here on the heels of upward-revised readings in each Could (revised from +11,200 to +16,500) and June (revised from -3,100 to unchanged).

Trying previous the current choppiness, the current knowledge point out a slowdown in restaurant job progress from the sturdy pandemic-recovery tempo. On common over the last 4 months, consuming and consuming locations added simply 7,200 jobs every month. That was lower than a 3rd of the typical month-to-month good points of almost 23,000 jobs in the course of the earlier 15 months.

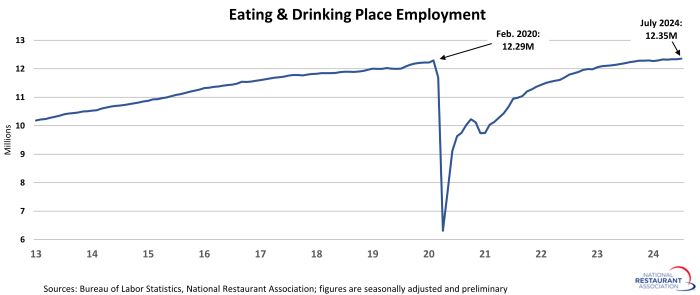

Whereas job progress slowed in current months, the scale of the business workforce continued to broaden its distance past pre-pandemic ranges. As of June 2024, consuming and consuming locations had been almost 64,000 jobs (or 0.5%) above their February 2020 employment peak.

Fewer job openings

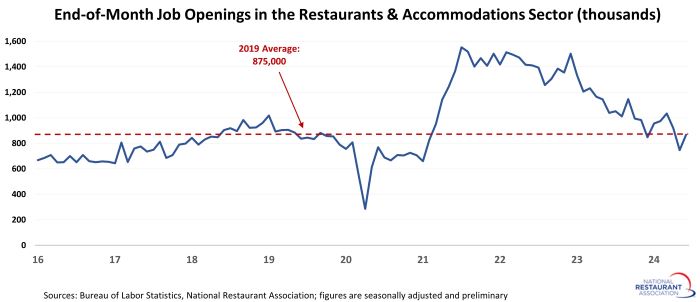

Coincident with the current slowdown in restaurant job progress was a normalization in measures of labor market churn. There have been 866,000 job openings within the mixed eating places and lodging sector on the final enterprise day of June, in keeping with preliminary knowledge from the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS).

That represented the second consecutive month wherein job openings had been beneath the 2019 common of 875,000. It was additionally nicely beneath the report highs of greater than 1.5 million openings registered a number of months throughout 2021 and 2022.

Holding the groups collectively

Extra importantly, restaurant operators are having rather more success retaining the workers that they’ve, relative to current years. Solely 3.8% of staff within the mixed eating places and lodging sector stop their jobs in June, in keeping with preliminary knowledge from BLS.

Excluding the early-pandemic months, that was the bottom month-to-month stop fee since Could 2015 (3.7%). It additionally represented the fifth consecutive month wherein the stop fee was beneath the 2019 month-to-month common of 4.9%.

Notice: The job openings and quits knowledge offered above are for the broadly-defined Lodging and Meals Companies sector (NAICS 72), as a result of the Bureau of Labor Statistics doesn’t report knowledge for eating places alone. Consuming and consuming locations account for almost 90% of jobs within the mixed sector.

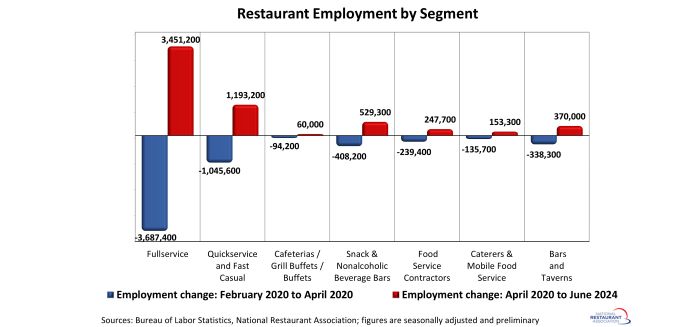

Fullservice section nonetheless down 236k jobs

The fullservice section skilled essentially the most job losses in the course of the preliminary months of the pandemic – and it nonetheless has the longest path to restoration. As of June 2024, fullservice restaurant employment ranges had been 236,000 jobs (or 4%) beneath pre-pandemic readings in February 2020.

Employment counts within the cafeterias/grill buffets/buffets section (-31%) additionally remained beneath their February 2020 ranges.

Job losses within the limited-service segments had been considerably much less extreme in the course of the preliminary months of the pandemic, as these operations had been extra prone to retain workers to assist their current off-premises enterprise. As of June 2024, employment at snack and nonalcoholic beverage bars – together with espresso, donut and ice cream retailers – was almost 121,000 jobs (or 15%) above February 2020 readings.

Staffing ranges within the quickservice and quick informal segments had been almost 148,000 jobs (or 3%) above pre-pandemic ranges. Headcounts at bars and taverns had been 32,000 jobs (or 7%) above the pre-pandemic peak.

[Note that the segment-level employment figures are lagged by one month, so June is the most current data available.]

Restaurant workforce developments uneven throughout states

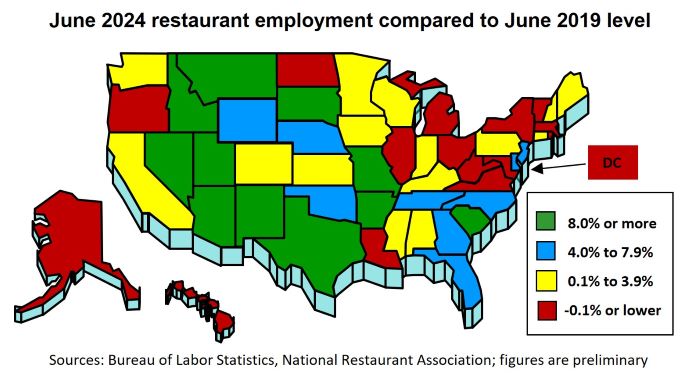

Restaurant employment developments proceed to fluctuate considerably by state. As of June 2024, 15 states and the District of Columbia had fewer consuming and consuming place jobs than they did in June 2019.

This group was led by Maryland, Louisiana and North Dakota, which had 6% fewer consuming and consuming place jobs in June 2024 than they did in June 2019. Hawaii (-5%), DC (-4%), Illinois (-3%) and Alaska (-3%) had been additionally beneath their pre-pandemic restaurant employment ranges.

As of June 2024, consuming and consuming place employment in 35 states surpassed their comparable pre-pandemic readings in June 2019. This group was led by South Dakota (+18%), Nevada (+15%), Utah (+14%), Idaho (+11%) and Texas (+10%).

[Note that the state-level analysis uses June 2019 as the pre-pandemic comparison instead of February 2020, because seasonally-adjusted employment figures are not available.]

*Consuming and consuming locations are the first element of the entire restaurant and foodservice business, offering jobs for roughly 80% of the entire restaurant and foodservice workforce of 15.5 million.

Learn extra analysis and commentary from the Affiliation’s economists.