Eating places expanded payrolls at a reasonable tempo in March, in keeping with preliminary knowledge from the Bureau of Labor Statistics (BLS).

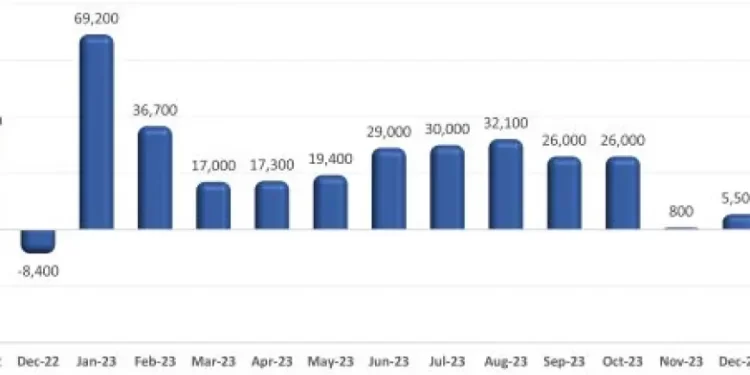

Consuming and ingesting locations* added a internet 28,300 jobs in March on a seasonally-adjusted foundation. That adopted a downward-revised improve of 28,500 jobs in February.

The February and March positive factors got here on the heels of a 3-month interval of below-trend job progress within the business. General between November 2023 and January 2024, consuming and ingesting place employment declined by practically 15,000.

Restaurant employment traits had been uneven in current months, however the business workforce maintained its place above pre-pandemic ranges. As of March 2024, consuming and ingesting locations had been 37,000 jobs above their February 2020 employment peak.

Fullservice section nonetheless down practically 250k jobs

The fullservice section skilled essentially the most job losses in the course of the preliminary months of the pandemic – and it nonetheless has the longest path to restoration. As of February 2024, fullservice restaurant employment ranges had been 248,000 jobs (or 4%) under pre-pandemic readings in February 2020.

Employment counts within the cafeterias/grill buffets/buffets section (-32%) additionally remained under their February 2020 ranges.

Job losses within the limited-service segments had been considerably much less extreme in the course of the preliminary months of the pandemic, as these operations had been extra prone to retain workers to help their current off-premises enterprise. As of February 2024, employment at snack and nonalcoholic beverage bars – together with espresso, donut and ice cream retailers – was 113,000 jobs (or 14%) above February 2020 readings.

Staffing ranges within the quickservice and quick informal segments had been 140,000 jobs (or 3%) above pre-pandemic ranges. Headcounts at bars and taverns had been 24,000 jobs (or 6%) above the pre-pandemic peak.

[Note that the segment-level employment figures are lagged by one month, so February is the most current data available.]

Restaurant workforce restoration uneven throughout states

Restaurant employment surpassed pre-pandemic readings on the nationwide stage, however the extent of the business’s workforce restoration varies considerably by state. As of February 2024, 26 states and the District of Columbia nonetheless had fewer consuming and ingesting place jobs than they did in February 2020.

This group was led by Maryland, which had 9% fewer consuming and ingesting place jobs in February 2024 than it did in February 2020. Louisiana (-7%), Vermont (-7%), Massachusetts (-6%), Hawaii (-6%), Maine (-6%) and Illinois (-6%) had been additionally properly under their pre-pandemic restaurant employment ranges.

As of February 2024, consuming and ingesting place employment in 24 states surpassed their comparable pre-pandemic readings in February 2020. This group was led by Nevada (+12%), Utah (+12%), Montana (+9%) and Idaho (+8%).

Slower job progress anticipated in 2024

The restaurant business will proceed increasing payrolls in 2024, albeit at a a lot slower tempo in comparison with current years. In complete throughout 2024, the Affiliation expects the general restaurant and foodservice industry so as to add an extra 200,000 jobs. That will be solely a 3rd of the 600,000 jobs added throughout 2023.

The expectation of slower job progress is corroborated by the downward development in job openings. On the final enterprise day of February, there have been 927,000 job openings within the mixed eating places and lodging sector, in keeping with knowledge from the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS).

That marked the fifth consecutive month with fewer than 1 million job openings, after spending a document 30 months above that stage. This means a cooling within the demand for workers, although postings nonetheless remained above the 2019 common of 875,000 job openings every month.

Observe: The job openings knowledge offered above are for the broadly-defined Lodging and Meals Providers sector (NAICS 72), as a result of the Bureau of Labor Statistics doesn’t report knowledge for eating places alone. Consuming and ingesting locations account for practically 90% of jobs within the mixed sector.

*Consuming and ingesting locations are the first part of the full restaurant and foodservice business, offering jobs for roughly 80% of the full restaurant and foodservice workforce of 15.5 million.

Learn extra analysis and commentary from the Affiliation’s economists, together with the newest outlook for consumers and the economy.