Greater than three years after the onset of the COVID-19 pandemic within the U.S. that resulted in hundreds of thousands of restaurant workers being laid off or furloughed, the dimensions of the business’s workforce lastly returned to pre-pandemic ranges.

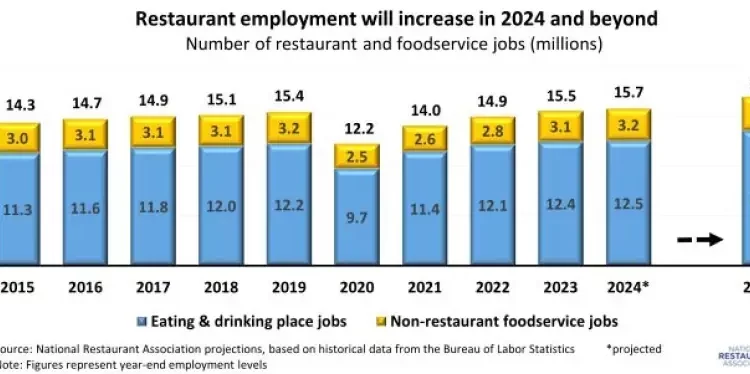

By the top of 2023, the restaurant and foodservice business was as soon as once more the nation’s second largest non-public sector employer, offering 15.5 million jobs – or 10% of the whole U.S. workforce. This included 12.4 million jobs at consuming and ingesting locations, plus an estimated 3.1 million foodservice jobs in different sectors equivalent to healthcare, lodging, schooling, food-and-beverage shops, and humanities, leisure and recreation.

The restaurant and foodservice workforce will proceed to develop in 2024, albeit at a a lot slower tempo than latest years when the business was recovering from pandemic losses. A projected enhance of 200,000 jobs will deliver complete business employment to fifteen.7 million by the top of 2024.

In the course of the subsequent a number of years, restaurant and foodservice employment will proceed to rise at a reasonable fee. Between 2024 and 2032, the business is projected so as to add 150,000 jobs a yr on common, with complete staffing ranges reaching 16.9 million by 2032.

The trail towards a deeper labor pool

To realize these long-term staffing wants, the U.S. labor power might want to increase at a fee above expectations – notably within the cohorts which might be essential to eating places.

Early within the pandemic, a pointy decline within the labor power contributed to record-high job openings throughout the financial system. Greater than 8 million individuals dropped out of the labor power between February 2020 and April 2020, and the general labor power didn’t return to pre-pandemic ranges till August 2022.

Importantly for eating places, labor power development was additionally seen throughout amongst youngsters and younger adults – cohorts that collectively make up 40% of the business workforce. Due largely to increased wages supplied by employers because of the tight labor market, younger employees have been more and more prone to enter the labor power in recent times.

In 2023, 36.9% of 16-to-19-year-olds have been within the labor power. This represented the very best stage since 2009 (37.5%), although it remained effectively beneath 1979’s file excessive of 57.9%. The 20-to-24-year-old participation fee stood at 71.3% in 2023, which was up considerably from the pandemic lows.

Wanting forward, the inhabitants of the 16-to-24 age cohort is projected to stay comparatively regular throughout the subsequent decade. Nevertheless, the Bureau of Labor Statistics (BLS) expects their labor power participation to say no steadily. This is able to lead to a pointy discount within the variety of youngsters and younger adults within the labor power.

Fortuitously, the previous few years supplied a transparent indication that the teenage and younger grownup workforce shouldn’t be written off, and they’ll come off the sidelines underneath the appropriate circumstances.

Moderately than declining as projected by BLS, a extra optimistic state of affairs may see the labor power participation charges of 16-to-24-year-olds remaining flat throughout the subsequent decade.

If the labor power participation fee of 16-to-19 yr olds holds regular on the 2023 stage of 36.9%, it will translate to an extra 1 million teenagers within the labor power by 2032, as in comparison with the present BLS projections.

Within the 20-to-24-year-old age cohort, a steady participation fee would lead to an extra 700,000 individuals within the labor power.

If the present participation fee of youthful employees could be maintained within the years forward, it will go a protracted approach to assuaging a few of the business’s staffing challenges.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.