The resiliency of the U.S. client was on full show in July, as restaurant gross sales posted a wholesome achieve.

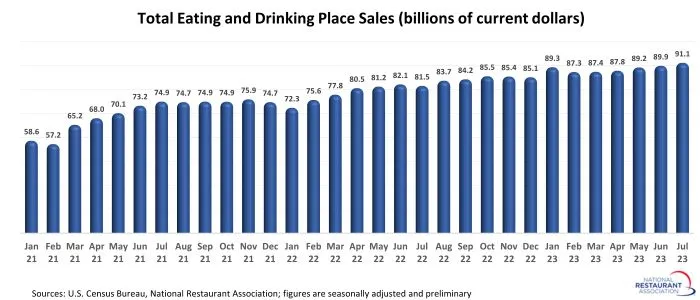

Consuming and ingesting locations* registered complete gross sales of $91.1 billion on a seasonally adjusted foundation in July, in line with preliminary information from the U.S. Census Bureau. That was up a powerful 1.4% from June’s gross sales quantity, which was revised larger from preliminary readings.

July represented the third consecutive month of stable restaurant gross sales progress, with revised information revealing a transparent upward pattern main into the summer time months. July’s wholesome improve got here on the heels of strong features in each Could (1.6%) and June (0.8%).

It wasn’t simply eating places that benefitted from shoppers’ continued willingness to spend. Complete gross sales in non-restaurant retail sectors rose 0.6% in July – the strongest month-to-month improve since January.

The current upward pattern in restaurant gross sales was much more spectacular contemplating that it occurred throughout a interval of slowing menu-price progress. In different phrases, gross sales progress wasn’t primarily pushed by larger menu costs, because it was for a lot of the previous yr.

After adjusting for menu value inflation, consuming and ingesting place gross sales have been up 4.4% between July 2022 and July 2023. Regardless of the uptick in actual gross sales progress, July’s gross sales quantity remained beneath January’s studying in inflation-adjusted phrases.

*Consuming and ingesting locations are the first element of the U.S. restaurant and foodservice business, which previous to the coronavirus pandemic generated roughly 75% of complete restaurant and foodservice gross sales. Month-to-month gross sales figures offered above characterize complete revenues in any respect consuming and ingesting place institutions. This differs from the Nationwide Restaurant Affiliation’s gross sales projections, which characterize meals and beverage gross sales at institutions with payroll workers.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.