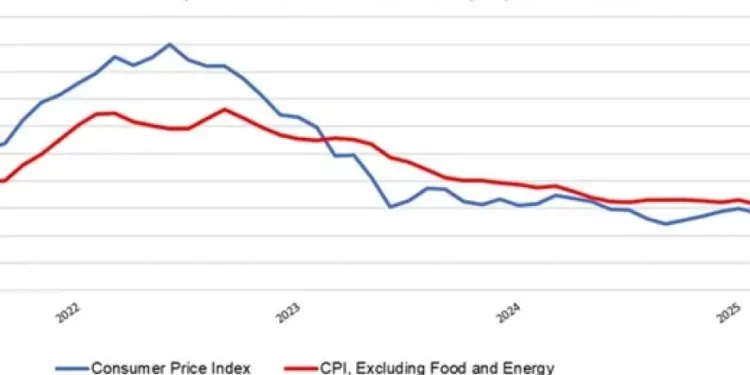

Shopper value knowledge have been restricted within the newest CPI launch because of the authorities shutdown. Headline inflation rose 2.7% year-over-year in November, easing from 3.0% in September, with no annual determine printed for October. Core CPI—which excludes meals and power—climbed 2.6% over the previous 12 months, down from 3.0% in September and marking the slowest tempo of underlying inflation since March 2021.

On the identical time, the Federal Open Market Committee lowered short-term rates of interest by 25 foundation factors at its December 9–10 assembly, its third consecutive lower. Policymakers signaled that extra reductions are seemingly in 2026, although at a measured tempo. The Federal Reserve stays extra involved a few cooling labor market than inflation pressures, whilst value development continues to run considerably above its 2% lengthy‑run goal.

Trying forward, the Fed is predicted to keep up its knowledge‑dependent stance in shaping financial coverage. Whereas it’s too quickly to find out whether or not charges might be lower on the January 27–28 or March 17–18 conferences, a transfer at a kind of conferences seems seemingly in our view.

Menu costs jumped between September and November

Menu costs jumped 0.5% over the two-month interval from September to November, a stable acquire after edging up 0.1% for the month of September. To date this 12 months, costs for meals away from residence have averaged month-to-month development of 0.3%. On a year-over-year foundation, menu costs have risen 3.7% since November 2024. As such, menu inflation stays agency, although effectively beneath the 8.8% peak seen in March 2023, the quickest charge in over twenty years.

Grocery costs fell 0.7% over the two-month interval from September to November, pulling again after experiencing robust month-to-month development of 0.4% in August and 0.5% in September. Yr-over-year, the CPI for meals at residence rose 1.9% in November, down from 2.7% in September. Grocery inflation has cooled significantly from its 13.5% peak in August 2022.

Within the meals away from residence class, menu costs at fullservice eating places elevated 0.6% over the two-month interval from September to November, with costs averaging 0.4% development every month up to now this 12 months, a stable tempo. In the meantime, limited-service menu costs elevated 0.4% over the two-month interval, with a month-to-month charge of 0.2% by the primary 11 months of 2026.

On a year-over-year foundation, full-service menu costs elevated 4.3% in November, whereas limited-service costs rose 3.0% year-over-year. Inflation in each segments has moderated considerably from earlier peaks: full-service restaurant costs surged as excessive as 9.0% year-over-year in 2022, whereas limited-service costs peaked at 8.2% in April 2023.

Throughout the broader food-away-from-home class, costs for meals from merchandising machines fell 0.9% over the two-month interval from September to November, erasing a lot of the 1.6% month-to-month acquire seen in September. Yr-to-date, merchandising machine costs have grown 0.5% every month. On the identical time, menu costs at worker websites and faculties edged down 0.1% over the two-month interval however have averaged 0.3% development per 30 days up to now in 2026. Costs at different meals away from residence places elevated 0.3% over the two-month interval, or 0.4% per 30 days on common from January to November.

Yr-over-year, costs at merchandising and cell distributors rose 5.7% since November 2024, with costs for meals at worker websites and faculties growing by 3.5%. The broader “different meals away from residence” class posted a 4.9% annual enhance in costs in September year-over-year.

Regionally, menu costs grew strongly over the two-month interval within the West (0.7%), Midwest (0.5%), and South (0.4%), with costs within the Northeast (0.1%) growing simply marginally. Over the previous 12 months, the West (3.9%) and Midwest (3.8%) skilled the quickest menu value development, with the South (3.6%) and Northeast (3.4%) nonetheless rising solidly however extra slowly.