Yelp Inc. (NYSE: YELP) at present launched third quarter knowledge for the Yelp Economic Average (YEA) report, a benchmark of native financial power within the U.S. The report has been tailored to disclose the dramatic affect COVID-19 has had on native economies, uncovering the resilience of native companies throughout the nation. Whereas our September Financial Influence Report and the newest unemployment figures present continued financial uncertainty, our knowledge finds that sure areas of the native economic system present promising indicators of adaptability.

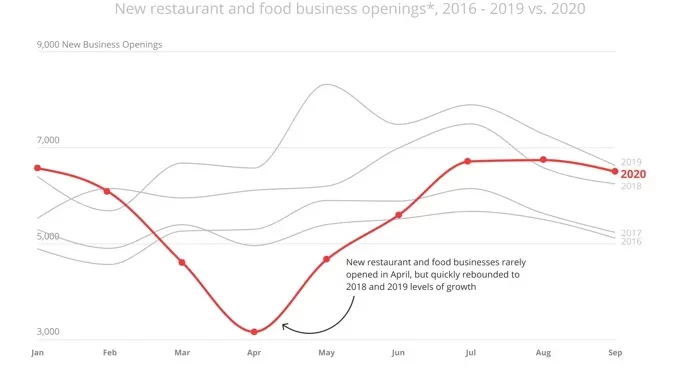

YEA finds that new restaurant and meals companies are opening at pre-pandemic ranges, with the variety of new openings more and more extra in step with 2018 and 2019 volumes. As well as, 210,000 companies have reopened that had been as soon as briefly closed, with a big enhance of reopenings in September 2020. The report additionally particulars client developments, surfacing out of doors eating because the breakout hit of the summer season, together with outdoor-related companies companies and leisure actions. In its third quarter report, YEA displays knowledge from thousands and thousands of native companies and tens of thousands and thousands of customers on Yelp’s platform, measuring U.S. enterprise openings and reopenings, in addition to client curiosity developments through search knowledge, web page views, critiques and images.

“Enterprise homeowners have confirmed their resilience all through the course of this pandemic. Many have been capable of efficiently reopen and preserve their doorways open by shortly innovating and adapting new working fashions to serve their prospects,” mentioned Justin Norman, Yelp’s vice chairman of knowledge science. “Eating places particularly have been examined within the final six months, however we’re now seeing new restaurant and meals enterprise openings align with opening charges from earlier years. In what at occasions looks as if a unending stream of challenges for enterprise homeowners, it’s encouraging to uncover these vibrant spots within the native economic system.”

New Restaurant and Meals Companies Proceed to Open Amid a Difficult Economic system

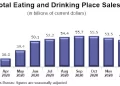

In April, eating places endured a big drop in new openings, nevertheless in Could a rebound had already begun, with a 29% common month-to-month enhance of recent restaurant openings from Could to July. New restaurant openings have stayed comparatively flat in August and September, with roughly 6,600 new eating places opening every month. There have been solely 100 fewer new restaurant openings in September of this 12 months, in comparison with September 2019. New restaurant openings in Q3 2020 are solely down 10% in comparison with Q3 2019.

In comparison with Q3 2019, Yelp noticed a rise in model new openings in Q3 2020, nationally, for open air meals companies together with: farmers markets (211 openings) and meals vans (1,734 openings). As well as, pop-up eating places (100 openings) and seafood markets (84 openings) skilled a rise in openings in comparison with the identical interval in 2019, catering to shoppers’ pursuits in novel methods to dine and store for meals exterior of conventional restaurant experiences. Yelp knowledge additionally signifies that openings elevated for meals companies specializing in celebratory treats which are typically loved at dwelling or bought as items, together with cupcakes (494 openings), customized truffles (512 openings), and desserts (1,615 openings).

Yelp measures neighborhood resilience by evaluating the speed of change of recent openings in Q3 relative to Q2, eradicating seasonal affect. Neighborhood resilience determines how nicely states have rallied to open new companies in Q3 in comparison with Q2 throughout the pandemic. States that confirmed essentially the most resilient third quarter for restaurant and food-related enterprise openings embody North Dakota (39 openings), Washington D.C. (108 openings), Rhode Island (69 openings), New Hampshire (103 openings), and Wyoming (34 openings) — all with no less than 2X the openings in Q3 in comparison with the earlier quarter. States with the most important whole variety of new openings in Q3 are typically bigger and closely populated, together with California (3,279 openings), Texas (2,002 openings), Florida (1,542 openings), New York (1,420 openings), and Washington (561 openings).

Enterprise Reopenings Rise Throughout the Nation in Q3

Amid a 12 months of unprecedented challenges for U.S. small companies, greater than 210,000 have reopened after non permanent closing (between March 1 and September 30). Yelp analyzed the reopening developments in every state by evaluating the change in reopenings month-over-month.

After the preliminary outbreak of the pandemic, enterprise reopenings started in April when many states started to elevate their stay-at-home orders in change for extra lenient laws. Nationally, Yelp knowledge exhibits a pointy spike in enterprise reopenings, month-over-month, of briefly closed companies in April and Could adopted by a decline in enterprise reopenings in June and July – when circumstances climbed once more throughout the nation.

Case containment responses on account of the early summer season spikes drove renewed momentum of reopenings in August and September. States that skilled a 30% or extra enhance in reopenings from July to August embody: Louisiana (90% enhance), Montana (86% enhance), South Dakota (55% enhance), North Dakota (50% enhance), Iowa (34% enhance), Indiana (35% enhance), and Wisconsin (30% enhance). These reopenings continued into September, when North Dakota, Alabama, Idaho, Wyoming, and Oregon skilled greater than 3X the variety of reopenings in September than in August.

Whereas the common charge of reopenings have slowed general since April and Could, Yelp knowledge exhibits companies are persevering with to reopen, significantly in September, as enterprise homeowners adapt to altering native laws and fluctuating COVID-19 an infection charges.

Reopenings Enhance Throughout Monetary Companies, Training, Lively and Magnificence Classes within the Third Quarter

Yelp’s September Native Financial Influence Report discovered that companies in dwelling, native, skilled, and automotive companies confirmed a decrease closure charge than restaurant and retail companies. Now, Yelp’s reopening knowledge helps a resurgence in demand for classes that had been beforehand pushed to briefly shut.

With college again in session, Yelp’s knowledge signifies that preschools, childcare and youngsters actions skilled excessive proportions of their reopenings in Q3 relative to their whole class openings since March 1, with 55%, 53% and 48%, respectively. Individuals are returning to train lessons with kickboxing and martial arts experiencing 68% and 46% of their reopenings in Q3. Magnificence salons are additionally making a comeback with 44% of reopenings for sugaring companies and 43% of reopenings for eyebrow companies occurring in Q3. Equally, leisure actions started to reopen at larger charges, together with film theaters, arcades and amusement parks, all with 54% to 53% of their reopenings within the third quarter.

A handful of dwelling and native companies companies skilled a big share of their openings in Q3, together with locksmiths, dwelling equipment restore and bike upkeep with 60%, 53%, and 47% of whole class reopenings within the quarter, respectively. As shoppers navigate the results of the pandemic on their private funds, many monetary service suppliers skilled a majority of their reopenings in Q3. Banks, monetary advisors, tax companies, insurance coverage corporations and investing companies led the best way, all with 68% to 56% of their class reopenings in Q3.

Shopper Curiosity is Up for Out of doors-based Skilled, Native, Auto and House Companies

All through the summer season, Yelp knowledge confirmed a rise in buyer curiosity for all issues outside. In Q3 2020, share of client curiosity surged for companies that restore and repair bicycles (104% enhance from a 12 months earlier), boats (75% enhance), and RVs (32% enhance), whereas shoppers’ common curiosity in RV parks (59% enhance) ramped up all through the summer season for each leisure and socially distanced journey.

Because the months heated up, shoppers invested in making their out of doors areas usable. Share of curiosity in dwelling companies for pool and sizzling tub companies, and for panorama structure, elevated by 41% and 35%, respectively.

Out of doors Eating Spikes as Shoppers are Desirous to Head Again to Eating places

Out of doors eating was one of many greatest developments of the summer season as diners appeared for methods to eat out whereas staying secure. In Q3 2020, the share of U.S. restaurant critiques mentioning ‘out of doors eating’ was greater than double the share in Q3 2019. And the share of U.S. restaurant searches utilizing the ‘out of doors seating’ filter on Yelp was up greater than 5X in comparison with the identical time final 12 months. Equally, assessment mentions for ‘road eating’ elevated 5X between Q3 and Q2 2020. To satisfy this unprecedented client demand, restaurant and food-related companies moved their current operations to sidewalks and streets, and launched new ventures catering to the demand.

Methodology

Enterprise Openings

Openings are decided by counting new companies listed on Yelp, that are added by both enterprise homeowners or Yelp customers. New openings on this report are particularly for restaurant and meals classes. Openings are adjusted year-over-year, which means openings in 2020 are relative to the identical time frame in 2019 for a similar class and geographic location. This adjustment corrects for each seasonality and the baseline degree of Yelp protection in any given class and geography.

Enterprise Reopenings

On every date, beginning with March 1, we rely U.S. companies that had been briefly closed and reopened by September 30. A reopening is of a short lived closure, whether or not through the use of Yelp’s non permanent closure function or by enhancing hours, excluding closures attributable to holidays. Every reopened enterprise is counted at most as soon as, on the date of its most up-to-date reopening.

Openings and reopenings are primarily based on after they’re indicated on Yelp, as such, the info could lag barely from the true opening or reopening date attributable to a delay in reporting from shoppers and enterprise homeowners.

Resilience

Neighborhood resilience compares the speed of enterprise openings per state from Q2 to Q3 in 2020 and adjusts for the pure charge of openings in 2019 to find out how nicely states have rallied to foster new enterprise throughout the pandemic.

Mathematically, resilience is calculated as Q3 YoY adjusted openings much less Q2 YoY adjusted openings divided by Q2 YoY adjusted openings. YoY adjusted openings are openings this 12 months divided by openings final 12 months (for any given month/quarter and so forth.).

Shopper Curiosity By Enterprise Class

We measure client curiosity, when it comes to U.S. counts of some of the numerous actions individuals take to attach with companies on Yelp: viewing enterprise pages or posting images or critiques. Shopper curiosity for every class is predicated on the Q3 year-over-year change within the class’s share of all client actions in its root class.

Assessment Mentions and Search Filters

For the info concerning out of doors eating, we measured the share of whole phrases in U.S. restaurant critiques containing phrases associated to out of doors eating. Equally, for search filters we measure the share of U.S. restaurant searches utilizing filters for takeout, supply, or out of doors seating.