The resilient U.S. labor market, which has fueled a lot of the present consumer-driven financial enlargement, confirmed indicators of weak point in latest months. The non-public sector added simply 258,000 internet new jobs in the course of the second half of 2025. That was down from a acquire of 475,000 jobs in the course of the first half of the 12 months and represented the weakest two-quarter stretch of personal sector job progress in practically 16 years (excluding the early-pandemic months).

On the identical time, the nationwide unemployment price stays low by historic requirements – simply 4.4% in December 2025 – and there hasn’t been a major uptick in layoffs. Nonetheless, the latest slowdown in job progress is a possible signal {that a} key catalyst of shopper exercise could also be shedding momentum.

It’s not only a softer labor market that may affect shoppers’ capability to spend. Rising debt ranges – together with an uptick in delinquency charges – will restrict the flexibility of some households to maintain spending. Nevertheless, the debt-to-income ratio stays fairly manageable in historic phrases, which reduces the fear considerably.

As well as, family wealth retains reaching new document ranges, which is able to proceed to spice up the boldness of shoppers with houses and investments.

Regardless of the combined alerts, the underlying fundamentals stay usually optimistic, which factors towards continued financial progress in 2026. Issue within the affect that modifications to federal revenue tax legal guidelines can have on households – together with each bigger tax refunds and decrease tax withholdings – and it’s possible that buyers on the combination will retain the monetary wherewithal to proceed spending in 2026.

This text presents the most recent developments in key indicators that affect shoppers’ capacity and willingness to spend. Go to this web page all year long for ongoing evaluation of the state of the American shopper.

Job progress slowed in latest months

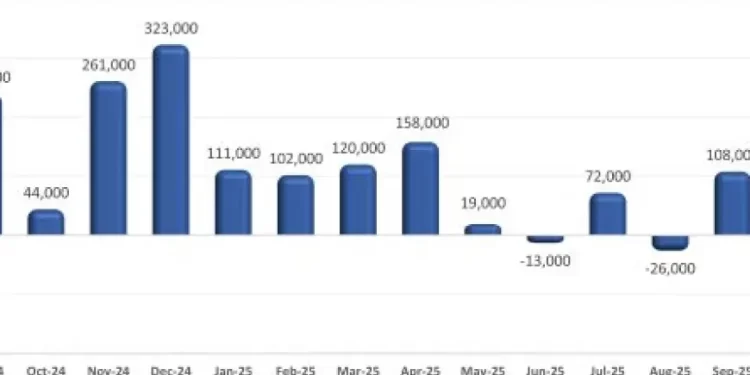

Employment progress within the nationwide financial system slowed dramatically in latest months, with employers including simply 87,000 internet new jobs in the course of the second half of 2025. That adopted a acquire of practically 500,000 jobs in the course of the first six months of the 12 months. Whereas the discount within the dimension of the federal authorities workforce drove a lot of the losses – together with 179,000 jobs in October alone – the non-public sector additionally slowed. Personal employers added 258,000 jobs in the course of the again half of 2025, down from 475,000 within the first half of the 12 months.

Client confidence stays dampened

Coinciding with the slowdown within the labor market, The Convention Board’s Consumer Confidence Index confirmed indicators of rising financial uncertainty amongst households. This measure of shopper sentiment trended steadily decrease throughout 2025, earlier than settling in January 2026 at its lowest degree in additional than a decade. That was largely because of declines within the expectations part of the index, which measures shoppers’ short-term outlook for revenue, enterprise, and labor market circumstances. Not surprisingly, shoppers on the decrease finish of the revenue scale are a lot much less assured within the route of the financial system.

Wage positive factors stay optimistic regardless of slowing job progress

Though job progress slowed in latest months, wage progress held up comparatively nicely. Common hourly earnings of personal sector workers elevated 3.8% between December 2024 and December 2025. That was 2 share factors beneath the robust positive factors posted throughout 2022, however nonetheless remained above the three.3% common enhance throughout 2019.

Financial savings price declined in latest months

Though nominal private revenue continues to rise at a average tempo, persistent inflation means progress is considerably muted in inflation-adjusted phrases. On the identical time, shopper spending has been outpacing revenue progress, which implies many households are tapping into their financial savings to assist these expenditures. This led to the private financial savings price falling to three.5% in November, its lowest degree since October 2022. It was additionally nicely beneath the pre-pandemic financial savings price, which averaged 6.5% between 2017 and 2019.

Family wealth surged in latest quarters

Family wealth continues to development sharply greater, rising by greater than $6 trillion within the third quarter of 2025. That adopted a rise of greater than $7 trillion within the second quarter, and represented seventh enhance within the final eight quarters. The one interruption of the optimistic trendline was a modest dip within the first quarter of 2025, which was due largely to a decline within the inventory market. In complete over the last eight quarters, complete family internet value jumped by practically $30 trillion. That positively impacts shoppers’ willingness to spend on discretionary gadgets, together with eating places.

Family debt continues to rise

Family debt trended steadily greater lately, with combination balances reaching $18.6 trillion by 2025:Q3. Mortgages symbolize the majority of family debt at 70%, adopted by auto loans (9%), pupil loans (9%) and bank cards (7%).

Debt to revenue ratio stays manageable

Although debt ranges are rising, it stays manageable in relation to revenue. On common in the course of the first three quarters of 2025, the overall family debt steadiness was about 81% of complete disposable private revenue. Other than two quarters in the course of the pandemic, that’s the bottom debt-to-income ratio in additional than twenty years. It’s additionally nicely beneath the document highs of greater than 116% registered in the course of the Nice Recession in 2007 and 2008.

Revolving credit score ranges proceed to rise

Revolving shopper credit score rose sharply over the last 5 years, following an early-pandemic interval throughout which balances dropped by greater than 12%. By November 2025, complete revolving credit score balances topped $1.3 trillion, which was practically $270 billion (or 26%) above their pre-pandemic peak.

Debt service stays in verify

Regardless of the elevated debt ranges, debt service stays manageable for households on the combination. The Federal Reserve’s Debt Service Ratio, which is the ratio of complete required family debt funds to complete disposable revenue, was simply over 11% in 2025:Q3. Whereas that was greater than the lows posted in the course of the first half of 2021, it remained barely beneath pre-pandemic readings.

Total delinquency charges are trending greater

Whereas debt service ranges remained manageable in historic phrases, general delinquency charges trended greater in latest quarters. As of 2025:Q3, 4.5% of excellent family debt was in some stage of delinquency. That was up 2 full share factors from the latest low of two.5% in 2022:This fall, and was approaching the 2019 common of 4.6%.

Bank card delinquencies are rising sharply

Together with an uptick in general delinquency charges, the proportion of bank cards that have been severely delinquent rose dramatically in latest quarters. As of 2025:Q3, 12.4% of bank card debt was not less than 90 days delinquent. That was up from a latest low of seven.6% in 2022:Q3 and represented the very best degree in additional than 14 years.