The upward pattern in restaurant gross sales continued in August, albeit on a considerably extra gradual path than the preliminary figures steered.

Consuming and ingesting locations* registered whole gross sales of $90.8 billion on a seasonally adjusted foundation in August, based on preliminary knowledge from the U.S. Census Bureau. That was up 0.3% from July’s downward-revised gross sales quantity of $90.5 billion.

August represented the sixth consecutive month of gross sales positive factors, with whole restaurant spending rising 4.0% throughout this era. As compared, whole gross sales in non-restaurant retail sectors had been up 1.0% over the last six months.

In inflation-adjusted phrases, consuming and ingesting place gross sales had been flat in August, because the 0.3% nominal gross sales acquire was matched by a 0.3% enhance in menu costs.

After adjusting for menu value inflation, consuming and ingesting place gross sales rose 1.8% between August 2022 and August 2023. Whereas the trendline was modestly optimistic in latest months, August’s gross sales quantity remained under January’s degree in actual phrases.

Pent-up demand stays agency

Based mostly on the Nationwide Restaurant Affiliation’s measures of pent-up demand, customers will doubtless proceed to go to eating places within the coming months – so long as they’ve the monetary wherewithal to take action.

Forty-six p.c of adults say they don’t seem to be going out to eating places as typically as they want, based on a survey fielded August 25-27, 2023. That was primarily on par with customers’ reporting in surveys fielded throughout the earlier 12 months.

In the meantime, 36% of adults say they don’t seem to be ordering takeout or supply from eating places as typically as they want. That was additionally just like readings within the final a number of surveys.

Not surprisingly, pent-up demand is larger amongst lower-income households, with 54% of customers in households with earnings under $50,000 saying they wish to be going out to eating places extra continuously.

Nonetheless, greater than 1 in 3 adults dwelling in households with earnings above $100,000 additionally say they don’t seem to be eating out at eating places as typically as they want.

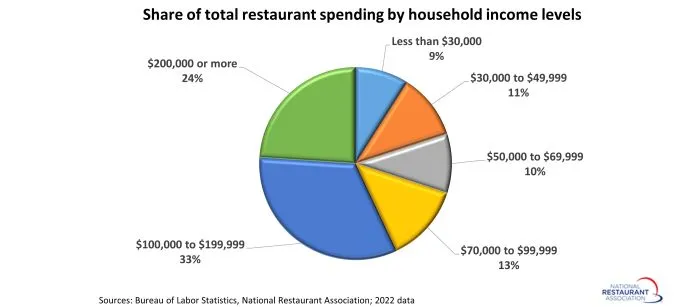

Any quantity of unfulfilled demand amongst higher-income households is a optimistic signal for eating places, as this demographic group represents the vast majority of spending within the business.

In line with knowledge from the Bureau of Labor Statistics, households with incomes of $200,000 or larger are accountable for 24% of the whole spending on meals away from dwelling, whereas households with incomes between $100,000 and $199,999 account for 33% of business spending.

Taken collectively, households with earnings above $100,000 are accountable for practically 6 in 10 {dollars} spent in eating places.

*Consuming and ingesting locations are the first element of the U.S. restaurant and foodservice business, which previous to the coronavirus pandemic generated roughly 75% of whole restaurant and foodservice gross sales. Month-to-month gross sales figures introduced above characterize whole revenues in any respect consuming and ingesting place institutions. This differs from the Nationwide Restaurant Affiliation’s gross sales projections, which characterize meals and beverage gross sales at institutions with payroll workers.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.