The coronavirus pandemic is having a devastating impression on the restaurant business. The proper storm of mandated enterprise closures, capability restrictions, and a cratered economic system led to the business’s most difficult enterprise circumstances in historical past. For eating places that depend on tourism for his or her enterprise, the unfavorable impression of the pandemic is much more important.

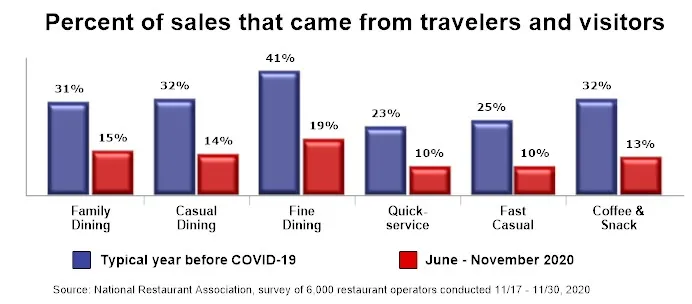

In a typical yr earlier than COVID-19, a median of 41% of gross sales within the tremendous eating section got here from vacationers and guests to the world, in keeping with Affiliation analysis. For some tremendous eating eating places, it’s a a lot bigger proportion: 1 in 4 tremendous eating operators say vacationers and guests accounted for no less than 60% of their gross sales pre-COVID.

Within the household eating, informal eating and coffee-and-snack segments, roughly one-third of gross sales got here from vacationers and guests in a typical yr earlier than COVID-19. Vacationers and guests accounted for roughly 1 in 4 {dollars} spent within the quickservice and quick informal segments pre-COVID.

With each private and enterprise journey considerably curtailed, tourism-related spending in eating places fell sharply in latest months. Within the tremendous eating section, vacationers and guests have been chargeable for solely 19% of gross sales through the June – November 2020 interval. It’s necessary to notice that this proportion relies on a a lot decrease gross sales quantity, which suggests the drop in tourism-related gross sales is considerably bigger than the decline in spending by native prospects.

The story was comparable in every of the opposite 5 main segments, because the % of gross sales coming from vacationers and guests in latest months was lower than half of what it was earlier than COVID-19. Eating places that rely on tourism for his or her enterprise will possible discover a longer highway to restoration than their counterparts that derive most of their gross sales from native prospects.

Learn extra analysis and commentary from the Affiliation’s chief economist Bruce Grindy.